This case study examines a startling instance of employment identity theft in April 2025, when Fort Worth resident Ileana Zuniga discovered her Social Security number had been used to claim $29,840 in wages from a Louisiana construction firm she’d never worked for. It explores the personal toll on Zuniga—sleepless nights, anxiety, and hours spent untangling the fraud—alongside the compliance scramble faced by the employer. Lastly, it outlines practical steps employees and organizations can take to prevent and respond to similar “ghost employee” schemes.

🕵️♀️ Case Background

Ileana Zuniga, 35, was stunned when a W‑2 form arrived reporting $29,840 earned at “MMR Constructors Inc.,” a company based in Baton Rouge, Louisiana—despite her never having set foot there or applied for such a job.

Upon contacting the listed employer, Zuniga learned that HR had a “no‑show” on file and no record matching her name or background.

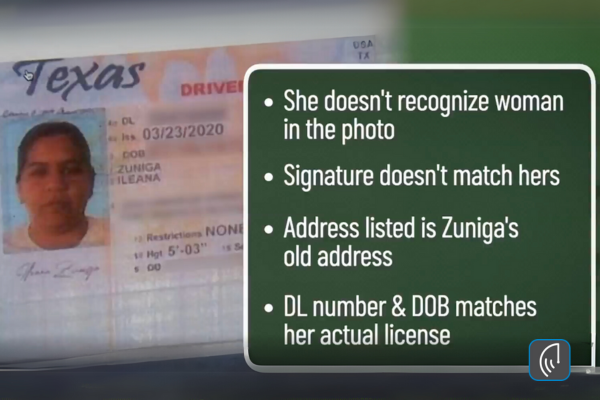

The employer’s paperwork included a forged job application, a copy of Zuniga’s real Social Security card, and a Texas driver’s license bearing her SSN and DOB but displaying an unfamiliar photo and forged signature.

Texas Department of Public Safety later confirmed the license was fraudulent and disclosed Zuniga was among approximately 5,000 customers notified of a 2023 security breach. NBC 5 Dallas-Fort Worth

😟 Victim Impact

For Zuniga, the fallout was immediate and profound:

-

Emotional distress: “The first two days, I couldn’t sleep at night. I was just thinking about it. That is very, very stressful,” she recalled.

-

Time investment: She filed police reports in both Texas and Louisiana, spent countless hours on calls with HR, DPS, and investigators, and monitored her credit around the clock.

-

Ongoing uncertainty: Despite learning no tax return had been filed under her name this year, Zuniga remains vigilant for further signs of misuse.

🏢 Employer Consequences

Organizations inadvertently hiring “ghost employees” face multiple risks:

-

Compliance exposure: U.S. Citizenship and Immigration Services requires completion of Form I‑9 with documents that “reasonably appear genuine” for every new hire USCIS.

-

Operational disruption: HR teams must halt normal workflows to investigate forgery, re‑verify legitimate staff, and coordinate with law enforcement.

-

Reputational harm: Public disclosure of such incidents can erode client and partner trust, suggesting insufficient vetting controls.

🛡️ Prevention & Response

For Employees:

-

Report identity theft immediately: Use IdentityTheft.gov to generate an FTC affidavit and recovery plan. IdentityTheft.gov

-

File IRS Form 14039: Submit the Business or Individual Identity Theft Affidavit to flag your tax account. IRS

-

Secure your SSA record: Create a “my Social Security” account to review earnings history. Social Security

-

Block electronic SSN access: Request a Block Electronic Access via SSA to prevent online or phone changes. Social Security

-

Lock your SSN in E‑Verify: Use the Self Lock feature in myE‑Verify to trigger a tentative nonconfirmation if someone else tries to use your SSN. E-Verify

-

Obtain an IRS IP PIN: A six‑digit Identity Protection PIN stops fraudulent returns under your SSN. IRS

For Employers:

-

Strengthen document verification: Train HR to spot counterfeit IDs and cross‑check photos against in‑person appearances.

-

Enable E‑Verify photo matching: If available, require E‑Verify’s photo‑matching service in addition to manual I‑9 checks. USCIS

-

Establish rapid‑response protocols: Designate a team to handle suspected fraud, including legal counsel, IT security, and communications.

-

Offer identity theft protection: Provide employees with monitoring, insurance, and resolution services as a voluntary benefit to reduce anxiety and recovery time.

⏳ Recovery Timeline

Victims of tax‑related identity theft face lengthy delays: the National Taxpayer Advocate reports IRS processing and refund resolution can take an average of 22 months. Taxpayer Advocate Service

📌 Conclusion & Key Takeaways

Ileana Zuniga’s experience underscores that employment identity theft can strike anyone—and that the ripple effects extend far beyond the individual to tax compliance, HR operations, and corporate reputation. By pairing vigilant document checks with employee education, rapid incident response, and robust protection services, organizations can deter ghost employees and help victims reclaim their identities more quickly.

Protecting your workforce isn’t just about technology—it’s about processes, training, and empathy.

Related to employment identity theft case study:

- Employer Providing Identity Theft Case Study

- Unemployment Fraud – Employer Guide