Enhancing Financial Institutions with Identity Protection Services (IDPS) is crucial in the intricate world of financial transactions, especially within mortgage dealings. IDPS serves as a vital line of defense, safeguarding sensitive data and financial exchanges from cyber threats. Below we will explore the crucial role of IDPS in financial services, focusing particularly on the mortgage sector, and demonstrate how they boost security and build customer trust.

The Imperative for Enhanced Security in Financial Services

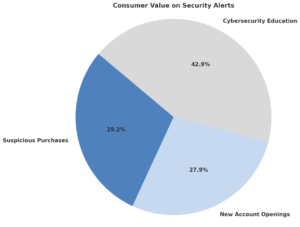

Recent data from Javelin research shows a clear demand for strong security. About 64% of consumers value alerts on suspicious purchases, and 61% like to be informed about new account openings. Yet, a remarkable 94% see the value in cybersecurity education from their FIs. This presents FIs with a great chance to boost trust and engagement. They can do this by offering timely alerts and useful educational content, keeping customers informed and safe from threats.

The Unique Dynamics of Mortgage Transactions

Mortgage transactions, characterized by their high value and sensitivity, present a lucrative target for cybercriminals. The involvement of extensive personal and financial information renders these transactions particularly vulnerable. Implementing IDPS in the mortgage process not only safeguards this sensitive data but also instills a sense of security in consumers, potentially enhancing the customer experience and trust in the financial institution.

Unpacking the Benefits of IDPS for Financial Institutions and Customers: The integration of IDPS offers multifaceted benefits:

- Proactive Threat Detection: IDPS systems enable real-time monitoring and detection of suspicious activities, significantly reducing the risk of data breaches and fraud.

- Enhanced Customer Confidence: With 94% of consumers valuing cybersecurity education, FIs that provide transparent, effective security measures and education can significantly bolster customer trust and loyalty.

- Adaptability to Emerging Threats: IDPS systems are continuously updated to counteract evolving cyber threats, ensuring robust protection for both the institution and its customers.

Financial Institutions Rising to the Challenge:

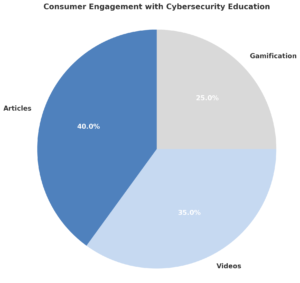

Banks like Truist and Bank of America lead with new security steps. They use virtual assistants and customized alerts. These meet various customer needs. Still, the work isn’t done. Only 14% of big FIs use phone alerts. Few use games to teach about cyber safety. There’s much room for growth.

The Consumer Perspective

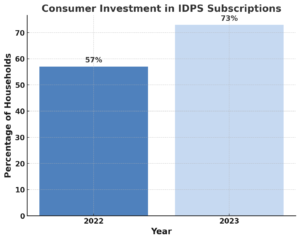

The growing consumer investment in IDPS, especially those including children, from 2022 to 2023 — increasing by 7 percentage points — signals rising awareness and demand for comprehensive family cybersecurity solutions. However, the perception of the necessity for full-family coverage remains low, with 61% of consumers not including children in their IDPS coverage, primarily due to a lack of awareness or underestimation of the risks of child identity theft.

The landscape of financial cybersecurity, particularly within the realm of mortgage services, is evolving rapidly. The role of Identity Protection Services in financial transactions and personal data has never been more critical. Financial institutions must not only adopt and enhance IDPS solutions but also actively educate and engage their customers on the importance of cybersecurity, turning the tide against cyber threats and fostering a safer financial ecosystem.

FAQs:

Q: What role do consumer preferences play in IDPS implementation?

A: Consumer preferences significantly influence the deployment of IDPS. Preferences include varying demands for alert types and communication methods. Tailoring these services to meet customer preferences can enhance engagement and efficacy.

Q: How do IDPS contribute to customer trust?

A: By actively protecting customers from cyber threats and educating them about security practices. IDPS enhances consumers’ confidence in their FIs, fostering stronger customer relationships.

Q: Can IDPS adapt to new types of cyber threats?

A: Yes, IDPS are designed to be dynamic and evolve in response to new cybersecurity challenges. This provides ongoing protection against a spectrum of digital threats.

Articles related to: Enhancing Financial Institutions with Identity Protection Services: A Must for Mortgage Companies

- Why Mortgage Lenders Need Employee ID Theft Protection

- Why Identity Theft Protection is Crucial for Mortgage Borrowers

- Home Buying and Identity Theft

- http://www.defend-id.com

Statistics from Javelin Research