by Brian Thompson | Mar 13, 2024 | Identity Theft, Mortgage

Enhancing Financial Institutions with Identity Protection Services (IDPS) is crucial in the intricate world of financial transactions, especially within mortgage dealings. IDPS serves as a vital line of defense, safeguarding sensitive data and financial exchanges from cyber threats. Below we will explore the crucial role of IDPS in financial services, focusing particularly on the mortgage sector, and demonstrate how they boost security and build customer trust.

The Imperative for Enhanced Security in Financial Services

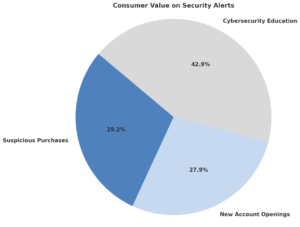

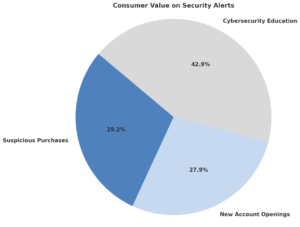

Recent data from Javelin research shows a clear demand for strong security. About 64% of consumers value alerts on suspicious purchases, and 61% like to be informed about new account openings. Yet, a remarkable 94% see the value in cybersecurity education from their FIs. This presents FIs with a great chance to boost trust and engagement. They can do this by offering timely alerts and useful educational content, keeping customers informed and safe from threats.

The Unique Dynamics of Mortgage Transactions

Mortgage transactions, characterized by their high value and sensitivity, present a lucrative target for cybercriminals. The involvement of extensive personal and financial information renders these transactions particularly vulnerable. Implementing IDPS in the mortgage process not only safeguards this sensitive data but also instills a sense of security in consumers, potentially enhancing the customer experience and trust in the financial institution.

Unpacking the Benefits of IDPS for Financial Institutions and Customers: The integration of IDPS offers multifaceted benefits:

- Proactive Threat Detection: IDPS systems enable real-time monitoring and detection of suspicious activities, significantly reducing the risk of data breaches and fraud.

- Enhanced Customer Confidence: With 94% of consumers valuing cybersecurity education, FIs that provide transparent, effective security measures and education can significantly bolster customer trust and loyalty.

- Adaptability to Emerging Threats: IDPS systems are continuously updated to counteract evolving cyber threats, ensuring robust protection for both the institution and its customers.

Financial Institutions Rising to the Challenge:

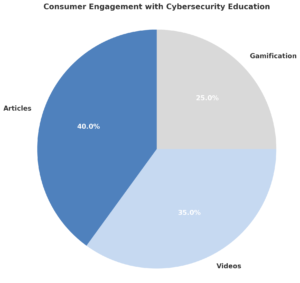

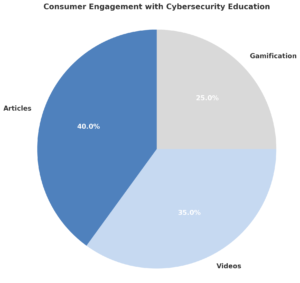

Banks like Truist and Bank of America lead with new security steps. They use virtual assistants and customized alerts. These meet various customer needs. Still, the work isn’t done. Only 14% of big FIs use phone alerts. Few use games to teach about cyber safety. There’s much room for growth.

The Consumer Perspective

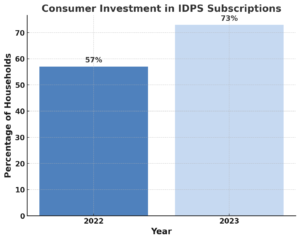

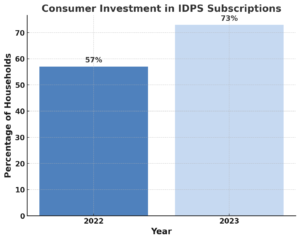

The growing consumer investment in IDPS, especially those including children, from 2022 to 2023 — increasing by 7 percentage points — signals rising awareness and demand for comprehensive family cybersecurity solutions. However, the perception of the necessity for full-family coverage remains low, with 61% of consumers not including children in their IDPS coverage, primarily due to a lack of awareness or underestimation of the risks of child identity theft.

The landscape of financial cybersecurity, particularly within the realm of mortgage services, is evolving rapidly. The role of Identity Protection Services in financial transactions and personal data has never been more critical. Financial institutions must not only adopt and enhance IDPS solutions but also actively educate and engage their customers on the importance of cybersecurity, turning the tide against cyber threats and fostering a safer financial ecosystem.

FAQs:

Q: What role do consumer preferences play in IDPS implementation?

A: Consumer preferences significantly influence the deployment of IDPS. Preferences include varying demands for alert types and communication methods. Tailoring these services to meet customer preferences can enhance engagement and efficacy.

Q: How do IDPS contribute to customer trust?

A: By actively protecting customers from cyber threats and educating them about security practices. IDPS enhances consumers’ confidence in their FIs, fostering stronger customer relationships.

Q: Can IDPS adapt to new types of cyber threats?

A: Yes, IDPS are designed to be dynamic and evolve in response to new cybersecurity challenges. This provides ongoing protection against a spectrum of digital threats.

Articles related to: Enhancing Financial Institutions with Identity Protection Services: A Must for Mortgage Companies

Statistics from Javelin Research

by Brian Thompson | Oct 11, 2023 | Identity Theft, Mortgage

The Hidden Vulnerabilities of Home Buying and Identity Theft are something every borrower should be aware of.

Buying a home is a dream come true for many. It’s a journey filled with excitement, anticipation, and, let’s be honest, a fair bit of “paperwork”. But amidst the hustle and bustle of mortgage applications and loan approvals, there’s a lurking threat that many homebuyers overlook: identity theft.

The Mortgage Process: A Double-Edged Sword

Imagine this: Sarah, a first-time homebuyer, is ecstatic about purchasing her dream home. She diligently provides all the necessary documents to her lender, from bank statements to tax returns. But a few weeks later, she discovers unauthorized transactions on her credit card. Her identity has been stolen, and now her financial stability and credit score are at risk.

It’s a nightmare scenario, but it’s not uncommon. In fact, over 7% of borrowers have their identities stolen, with the average loss amounting to a staggering $1,343, according to the FTC. And the repercussions don’t stop at the individual level. Lenders face the brunt too, with the average default costing them a whopping $50,000, as reported by the Mortgage Bankers Association.

Why is the Mortgage Process Vulnerable?

The mortgage process inherently requires sharing a plethora of personal and financial information. This data, if not adequately protected, becomes a goldmine for identity thieves. Unauthorized transactions, credit lines, and other financial disruptions can severely impact a borrower’s credit score and overall financial health. The ripple effect? Strained finances, jeopardized homeownership, and potential legal battles. Not to mention the emotional strain that impacts the family and their work.

Lenders, It’s Time to Step Up!

While borrowers need to be vigilant, lenders play a pivotal role in safeguarding their clients. After all, a lender’s reputation is built on trust and security. By incorporating identity theft protection programs, lenders not only protect their financial interests but also solidify their position as trusted, customer-centric institutions. It’s a win-win: lenders reduce the risk of loan defaults, streamline operations, and foster stronger customer relationships, while borrowers enjoy peace of mind and financial stability.

What Can Borrowers Do?

- Stay Informed: Knowledge is power. Understand the risks and be proactive in safeguarding your information.

- Ask Questions: When choosing a lender, inquire about their identity protection measures. It’s not just about interest rates; it’s about your overall security.

- Stay Vigilant: Regularly monitor your credit reports and bank statements. If something looks amiss, report it immediately.

- Get the defend-id Checklist and Tips for borrowers

A Final Thought

In the ever-evolving landscape of the mortgage industry, it’s crucial for both borrowers and lenders to stay ahead of potential threats. As a borrower, always remember to prioritize your financial security. And for lenders, consider this: in a market driven by trust, offering comprehensive identity protection isn’t just a service—it’s a commitment to your client’s well-being, all while creating lifetime value.

So, the next time you embark on the home-buying journey, remember to look beyond interest rates and loan terms. Ask your lender about their commitment to protecting your identity. After all, your dream home deserves a dreamy, worry-free experience. Home Buying and Identity Theft do not have to go hand in hand.

related articles:

by Brian Thompson | Sep 28, 2023 | Identity Theft, Mortgage

Why Lenders and Borrowers Should Prioritize Identity Theft Protection. Unraveling the Multifaceted Benefits of Identity Theft Protection in Mortgage Lending and Its Influence on Borrower Choices. Elevating Security in Home Financing and Creating Lifetime Value.

In an era where digital transactions dominate and sensitive information is routinely exchanged, safeguarding against identity theft is not a luxury, but a necessity. Especially in mortgage lending, where intimate financial details are shared, the repercussions of identity theft are grave for both lenders and borrowers. Enlightened lenders offering identity theft protection are not just meeting a need but setting an industry benchmark and gaining a definitive competitive advantage.

Why Lenders Should Offer Identity Theft Protection

- Building Trust and Loyalty:

A lender offering identity theft protection is a lender dedicated to safeguarding borrower’s personal information. This unwavering commitment fosters unparalleled trust, cultivates enduring relationships, and solidifies borrower loyalty – the bedrock of a successful lending enterprise.

- Mitigating Risks and Financial Losses:

Protecting borrowers from identity theft isn’t only about consumer welfare; it’s about securing investments, minimizing the possibility of loan defaults, and reducing potential financial losses. It’s an all-around win!

- Enhancing Brand Image and Reputation:

A robust identity theft protection program isn’t just a security measure; it’s a testament to a lender’s dedication to their clients, significantly bolstering their brand image, reputation, and customer satisfaction.

- Staying Ahead in the Market:

Offering added security features not only differentiates lenders in a saturated market but also serves as a unique selling proposition. In the eyes of discerning borrowers, a commitment to security is a commitment to their well-being.

- Legal and Compliance Advantages:

Aligning with stringent data protection standards, lenders can display adherence to industry best practices, potentially reducing regulatory hurdles and liabilities.

- Technological Edge:

Adopting advanced protection programs shows a lender’s dedication to innovation and combating cyber threats, appealing to tech-savvy borrowers, and highlighting a forward-thinking approach.

Why Borrowers Should Care

- Preserving Financial Stability:

Identity theft can derail financial stability. For borrowers, protection against such calamities is not just an add-on; it’s a fundamental necessity ensuring their path to homeownership stays secure.

- Maintaining Credit Health:

With protection in place, borrowers can support their credit health, shielding their financial future from the ramifications of identity theft.

- Choosing a Caring Lender:

Opting for a lender who prioritizes security is choosing a partner who values and respects their privacy, a crucial factor in the decision-making process.

Real-Life Impact: Testimonials

- “The Recovery Advocate that helped me with my identity theft event and provided everything that I needed to protect myself from problems that may occur in the future. She was very calm and reassuring.” Candy R.

- “My advocate was better than awesome. We tried to settle this without any help, and it was horrible. After we contacted our financial institution and were referred to our advocate, it went smoothly, and she was extremely helpful. Thank you.” David B

- “My Fraud Specialist is a godsend. Her professionalism and knowledge really helped put my mind at ease. I feel like I have a friend looking out for me.” Michael D.

The Decision-Making Factor

When selecting a mortgage lender, borrowers weigh several factors – competitive interest rates, exceptional customer service, favorable loan terms, and in today’s digital age, security. A lender proactively offering identity theft protection conveys a potent message: “We value and protect your privacy.” This assurance can be the decisive factor, tipping the scales in favor of a lender who not only offers loans but also security, trust, and peace of mind. A Lender Elevating Security in Home Financing!

Secure Your Future, Choose Wisely

The integration of identity theft protection in mortgage lending is not just a trend; it’s a vital and necessary evolution. Lenders incorporating such programs stand distinct, and discerning borrowers are taking notice. In a world where data breaches are rife, a lender who champions protection is a lender who earns trust. Trust is the cornerstone of every successful borrower-lender relationship.

Secure your future; choose a lender that prioritizes your security. Lenders, it’s time to step up and offer the protection your borrowers deserve!

Related Articles to Elevating Security in Home Financing:

by Brian Thompson | Sep 20, 2023 | Employee Benefits, Identity Theft, Mortgage

Did you know that something as simple as a change of address can protect or expose you to identity theft? Let’s dive in and discover why change of address monitoring helps in safeguarding your identity!

What is “Change of Address” Monitoring?

Imagine you’re moving to a new house. You’d want all your letters and packages to come to your new address, right? That’s when you inform the post office to redirect all your mail. But what if someone sneaky does this without you knowing? That’s where change of address monitoring steps in. It watches for any changes to your address and alerts you if something looks fishy.

Why is Address Monitoring Important?

- Stay In The Know: With address monitoring, you’ll always know where your mail is heading. No more lost birthday cards or missing bills!

- Spot The Bad Guys: If a sneaky person tries to change your address without you knowing, this tool will quickly let you know.

- Peace of Mind: You can sleep better knowing that you have an extra layer of protection for your personal info.

How Can Criminals Misuse Address Changes?

You might wonder, “Why would anyone want to change my address?” Here’s the scoop:

- Stealing Your Stuff: By rerouting your mail, criminals can snatch credit card offers, checks, or new credit cards before you even know they’re missing.

- Gathering Information: Identity thieves love to collect personal info. With your mail, they can learn a lot about you and potentially misuse it.

- Hiding Their Tracks: If they change your address, you might not get important bills or alerts, giving them more time to cause mischief.

Make Address Monitoring Your Secret Weapon!

You wouldn’t leave your front door unlocked, so why leave your mailbox unprotected? Change of address monitoring is like a security guard for your mail. By being in the know, you can stop identity thieves in their tracks.

*Interesting Fact: According to experts, millions of people have their identities stolen every year, but those with monitoring tools are more likely to catch and stop the bad guys!

Your address is more than just where you live. It’s a gateway to your personal information. By keeping an eye on any changes, you’re not only protecting your mail but also your identity. So, be smart, be safe, and consider adding address monitoring to your safety toolkit!

Remember: Safety first, because your identity is priceless!

Related articles to Change of Address Monitoring: Safeguarding Your Identity:

by Brian Thompson | Sep 6, 2023 | Employee Benefits, Identity Theft, Mortgage

The mortgage lending industry is a crucial pillar of the American dream. It enables people to buy homes, build credit, and secure a future for their families. But there’s a hidden threat jeopardizing this dream for everyone involved: identity theft and fraud. As a responsible mortgage lender, it’s not just good ethics but also good business sense to protect your employees from identity theft. Why? Because doing so further shields your company, your reputation, and most importantly, your borrowers. In this article, we’ll explore the many compelling reasons why mortgage lenders need employee ID Theft Protection to create a Safer, Trustworthy Business Environment.

The Domino Effect: Employees to Borrowers

Mortgage lenders handle a mountain of sensitive information daily. From Social Security numbers to financial statements, your company is a treasure trove for cybercriminals. If an employee’s identity is compromised, the ripple effects can easily extend to your borrowers and tarnish your brand reputation. Identity theft can also lead to cybersecurity issues.

No One Is Immune

We often think it won’t happen to us, but statistics suggest otherwise. According to a report by the Federal Trade Commission, there were 2.4 million identity theft reports in 2022 alone. If an employee falls victim to identity theft, they might inadvertently put borrowers’ data at risk due to distractions or emotional distress.

The Cost of Negligence Is High

Failing to protect your employees and, consequently, borrowers can result in severe financial repercussions. Legal consequences/Legal fees, penalties, and loss of business can add up quickly. Your reputation can take years to rebuild, and some borrowers may never return.

Peace of Mind Equals Productivity

Knowing that they’re protected, employees are more likely to be focused and efficient. They will handle borrowers’ information with the care it deserves, making your borrowers feel secure and satisfied. Happy borrowers lead to positive reviews, and we all know how vital those five-star ratings are in the digital age.

Easy Implementation

There are several top-notch identity theft protection services designed specifically for businesses. These platforms offer a variety of features, such as credit monitoring, alerts, and recovery services, that safeguard your employees’ identities. These services, such as defend-id, are designed to enhance employee safety where they protect sensitive data, and provide financial security.

In a world where data breaches are increasingly common, providing your employees with identity theft protection is not just an added benefit but a necessity. This proactive step will protect your company, preserve your reputation, and most importantly, offer peace of mind to your borrowers. Make the smart move today to shield your tomorrow.

With identity theft protection for employees, everyone wins—you, your staff, and your valued borrowers. Secure your business’s future by making this crucial investment now.

Articles Related to Why Mortgage Lenders Need Employee ID Theft Protection: