defend-id | blog

Insights & developments in Identity Protection

TikTok: A Parental Guide for Protecting Children

As a parent, it's important to be aware of the potential dangers and harmful content on TikTok, a popular social media platform among children. This guide provides information on TikTok parental controls and the reasons why it may be best to keep children off the app....

Artificial Intelligence & Social Engineering: You Need to Know

Artificial Intelligence (AI) has come a long way, bringing numerous benefits. However, it also has the potential to be used for malicious purposes, especially in social engineering. This article will show you how AI can manipulate people and why it's crucial to be...

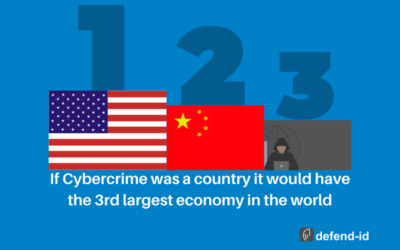

3rd Largest Economy – Cybercrime

Cybercrime is the third largest economy in the world, with costs estimated at around $8 trillion globally. This staggering figure highlights the alarming reality of the current digital landscape and the importance of taking cybersecurity measures seriously. The United...

Protecting Employees & Securing Success

In today's fast-paced business world, small business owners face numerous challenges. Challenges include the cost of providing valuable employee benefits while also keeping expenses low. However, with the growing threat of identity theft, it's essential to find a way...

What’s Fully Managed Recovery for Identity Fraud

What is Fully Managed Recovery for identity fraud, and how does it improve the employee's experience? Fully managed identity theft recovery is a service offered by some companies that helps individuals who have been the victims of identity theft. The service typically...

Life Insurance Fraud?

Life insurance fraud is a criminal act in which an individual or group of individuals intentionally deceives an insurance company in order to receive a financial benefit or payout from a life insurance policy. This can occur in a variety of ways, from exaggerating or...