Unfortunately, scammers often see students as easy targets for identity theft. Assuming, as young adults, they are less knowledgeable about identity theft and fraud. Often, students are more likely to fall victim to identity fraud and a lot of that has to do with the environment they are in, the way they communicate, and the information they have to share with the school. With these 7 student identity theft protection tips, students will be better prepared as they embark on their college life.

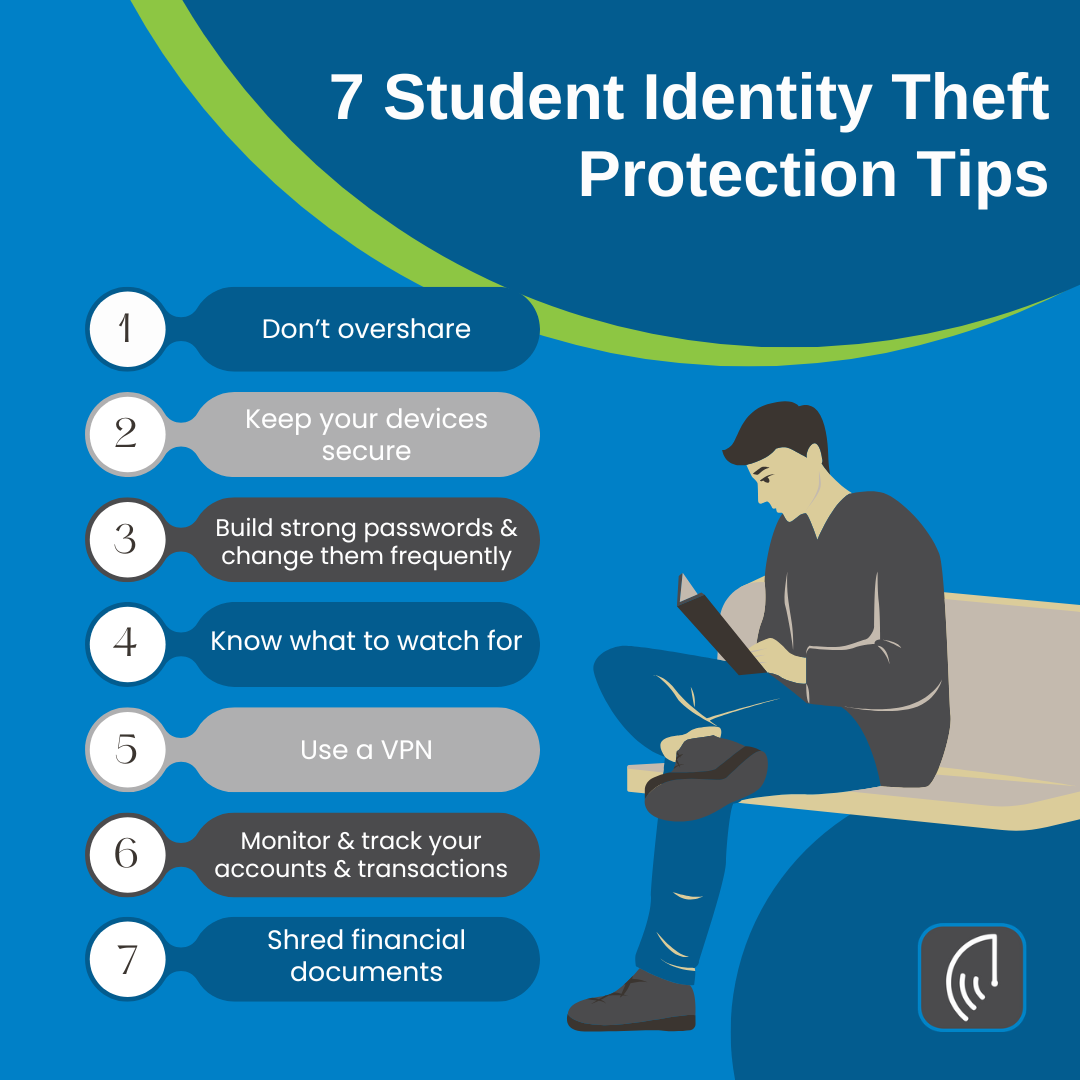

7 Student Identity Theft Protection Tips

- Don’t overshare.

Social media can make it easy for a scammer to learn personal details about you. Be careful what information you share on these sites because you never know who might see your posts. Your birthday, address, previous schools, and even your pets’ names could be used to gain access to your passwords and accounts if you’ve used them as answers to security or password retrieval questions.- Speaking of oversharing, be particularly protective of your Social Security number. There are very few instances when it is necessary to provide it (possibly when you’re applying for financial aid or for a job). Make certain that the party requesting your SSN is reputable. Ask them why it’s needed and how they will keep your number secure. Never carry your Social Security card with you; keep it, along with any other documents containing your personal information, in a safe or other secure location.

- This also means keeping your Federal Student Aid (FSA) ID private. For questions about financial aid, contact the Federal Student Aid Information Center at studentaid@ed.gov or 1-800-4-FED-AID — don’t give out personal information over the phone unless you initiated the contact.

- Keep your devices secure.

Would the thief be able to access any private information? Use your security settings to their fullest and be careful what you store on your hard drive. Saved logins and easily accessible personal data make it easy for whoever stole your device to take over your identity. - Build strong passwords and change them frequently.

It may be tempting to use the same passwords across your accounts so they are easy to remember, but don’t! Make passwords stronger by taking out vowels and adding in special characters. Most sites have their own requirements for what makes a password strong; typically, they should be unique, around 10 characters long, and not easy to guess. -

Know what to watch for

Think before you click, phishing scams come in all shapes and sizes. For example, fake scholarships and loan listings can be used to target college students. Before sharing any personal information on an application, be sure that the institution is reputable. Look closely for anything suspicious. If a scholarship application asks you to pay an application fee or provide your bank account information, it’s probably NOT legitimate.

- Secure your connection with a VPN, (Virtual Private Network).

Unsecured computer networks make it easy for others to hack your personal information. Since secure network connections are not always available in libraries, student centers, or other public places, use a VPN to encrypt your online activity. Related Article: Public WiFi is Putting You at Risk - Monitor and track your accounts and transactions.

Review your financial accounts frequently. Monitoring your bank statements, credit card bills, and credit score can help you notice suspicious activity and resolve it quickly. Enable two-factor authentication, which makes it more difficult for scammers to get access. Set up transaction alerts to be notified of suspicious account activity. And always log out of online banking and other secure sites before exiting. If you ever notice questionable account activity, whether login attempts from unknown devices or purchases you didn’t make, report them to the related institution immediately. That institution will provide you with the next steps, such as freezing the account or sending you a new card, to help protect your identity. - Shred financial documents.

Financial documents often include personal information that you don’t want out in the open. Shred or black out the information printed on credit card offers, as well as on any bank or credit card statements you may receive in the mail, before disposing of them

So stay diligent, think before you click, and use these 7 Student Identity Theft Protection Tips. Identity theft can follow a student well into their professional career and family life. Do what you can now to prevent issues in the future.

Students Targeted for Identity Theft

Online Students are Targeted