In the evolving landscape of employee benefits, one crucial aspect often remains overlooked: identity theft protection. Employers are striving to provide comprehensive benefits packages that cater to the diverse needs of their workforce. BUT, Identity theft protection is an offering that has yet to receive the attention it truly deserves. There are 4 reasons agents don’t offer identity theft protection.

Below are the four most common objections we hear, keeping identity theft protection from benefits conversations. We unravel the layers of misconception and reveal reasons why identity theft protection should be in every company’s benefits portfolio. From debunking cost concerns to showcasing the tangible advantages for both employers and employees, we’ll illuminate how identity theft protection not only shields against financial turmoil but also nurtures a culture of trust and security within the workplace.

4 Objections

- Cost: While it’s true that identity theft protection can come with a cost, it’s important to consider the potential long-term savings. (defend-id Plans overview – it might be less expensive than you think) In the unfortunate event of a data breach or identity theft incident affecting employees, the costs can skyrocket due to legal fees, reputational damage, and employee downtime. By investing in identity theft protection as an employee benefit, companies proactively mitigate these potential financial burdens. Plus, the cost of offering this benefit is outweighed by improved employee morale, loyalty, and overall productivity.

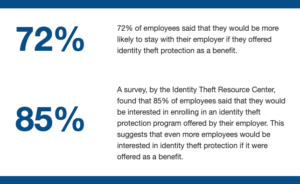

Lack of Demand: It’s understandable to have concerns about demand, but identity theft is a pervasive and growing issue impacting millions of employees yearly. Even if employees haven’t expressed an interest in identity theft protection, it doesn’t mean they wouldn’t value the added security and peace of mind. Offering this benefit demonstrates your commitment to their well-being and financial security. Additionally, proactive education about the risks of identity theft could help employees recognize its importance and drive demand over time. Here are statistics by the Identity Theft Resource Center showing a clear demand for the benefit:

Lack of Demand: It’s understandable to have concerns about demand, but identity theft is a pervasive and growing issue impacting millions of employees yearly. Even if employees haven’t expressed an interest in identity theft protection, it doesn’t mean they wouldn’t value the added security and peace of mind. Offering this benefit demonstrates your commitment to their well-being and financial security. Additionally, proactive education about the risks of identity theft could help employees recognize its importance and drive demand over time. Here are statistics by the Identity Theft Resource Center showing a clear demand for the benefit: - Limited Knowledge: Identity theft protection is increasingly relevant in today’s digital world. Taking the time to familiarize yourself with reputable identity theft protection providers and their features will not only enhance your credibility but also allow you to tailor solutions that best fit your client’s needs. Partnering with knowledgeable providers can also provide the necessary support to address any questions or concerns you may have.

- Concerns about Privacy: Privacy is a valid concern, but reputable identity theft protection providers prioritize data security and confidentiality. When partnering with established providers, you can assure your clients that stringent measures are in place to safeguard sensitive information. Offering identity theft protection can be an opportunity to educate employees about the importance of secure data handling and protection practices. Clear communication about how their data will be used and secured can help alleviate concerns and build trust.

Identity theft protection is a valuable benefit that employers should consider offering to their employees.

It can help to protect employees from the financial and emotional harm of identity theft, and it can also save employers money in the long run.

Cost, lack of demand, limited knowledge, and concerns about privacy are all valid concerns, but they can be overcome. By partnering with a reputable identity theft protection provider, employers can ensure that their employees’ data is secure and that they have access to the resources they need to protect themselves from identity theft.

Offering identity theft protection is a way to show employees that you care about their well-being and financial security. It is also a way to protect your company from the financial and reputational damage caused by an identity theft incident.

If you are an employer, I encourage you to consider offering identity theft protection as a benefit to your employees. It is a wise investment that can protect your employees and your company.

Related Articles

- Agents Offer Identity Theft Protection?

- 5 Reasons Employers Offer Identity Protection

- Financial Wellness in the Workplace