Why a VPN is a Must-Have for SMBs

Small and medium-sized businesses (SMBs) face the same cybersecurity threats as large corporations, without having the same budgets or dedicated security teams. Cybercriminals know this, so they’re increasingly targeting smaller companies with phishing attacks, ransomware, data breaches, and network intrusions. In fact, recent studies show that over 40% of cyberattacks today specifically target small businesses. This is why a VPN for small businesses is critical.

To protect your company from these threats, a Virtual Private Network (VPN) isn’t just beneficial—it’s essential. Remote WorkForce VPN is designed precisely for SMBs, offering business-level security without enterprise-level costs or complexities.

Why VPNs Are Crucial in a Remote and Hybrid World

With more employees working remotely, secure internet access has become vital. Employees regularly access company files, applications, and emails from home offices, airports, coffee shops, or hotels. Unfortunately, these public networks often lack security and are easy targets for cybercriminals.

A VPN solves this problem by creating an encrypted tunnel between an employee’s device and your company resources. As a result, it prevents unauthorized access, protecting credentials, customer information, and intellectual property from theft.

As cyberattacks continue to evolve, a VPN provides your first and most effective defense when employees connect from outside your secure office network.

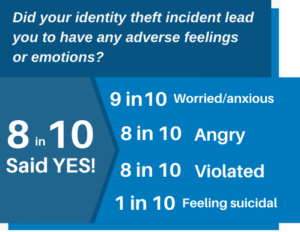

Why Cybercriminals Target SMBs

You might assume your business is too small to attract cybercriminals. However, attackers think otherwise. Smaller companies often lack proper security measures, have outdated systems, or inconsistent policies. Additionally, many SMBs don’t have a full-time cybersecurity staff or IT team.

Even one compromised device can lead to data theft, costly fines, or significant disruption. Therefore, proactive cybersecurity, starting with a reliable VPN, is essential—not optional.

What Makes Remote WorkForce VPN Different

Many VPN solutions exist, but few cater specifically to SMB needs. Remote WorkForce VPN stands out in several key ways:

-

Easy to Deploy: Our cloud-based VPN can be set up within minutes, whether you have five employees or fifty. There’s no complicated hardware or difficult network configuration needed. Thanks to a simple interface and guided setup, you don’t need to be tech-savvy to secure your business.

-

Fast Performance: Many VPNs slow down internet connections—but not Remote WorkForce VPN. Using advanced traffic optimization and high-speed global servers, our VPN provides seamless, encrypted connections. Consequently, employees can work without delays or interruptions.

-

Strong Encryption: Our VPN uses military-grade encryption (AES-256) and trusted protocols (WireGuard and OpenVPN). This ensures all data remains secure during transmission, whether accessing cloud services or sending confidential documents.

-

Multi-Device Protection: Employees switch between laptops, tablets, and smartphones. Remote WorkForce VPN covers all major platforms—Windows, macOS, iOS, Android—protecting your team no matter their location or device.

-

Affordable Pricing: Most enterprise VPNs are expensive. In contrast, Remote WorkForce VPN offers flexible pricing specifically for small businesses. Thus, you pay only for the features you need, scaling affordably as your company grows.

Compliance and Building Client Trust

If your business manages customer data, financial details, or health records, using a VPN helps you comply with regulations such as HIPAA, GDPR, or PCI-DSS. Secure remote access is often required in compliance audits.

Moreover, clients and partners trust businesses that prioritize data security. Adopting a VPN shows your commitment to protecting sensitive information, helping build lasting credibility and trust.

VPNs and ZTNA: Better Together

Although Zero Trust Network Access (ZTNA) solutions are beneficial, VPNs remain effective, especially as part of a layered cybersecurity strategy.

VPNs are excellent at encrypting traffic and providing secure connections for employees, contractors, or consultants who require extensive resource access. For many SMBs, starting with a VPN and gradually moving toward ZTNA makes practical and financial sense.

Bottom Line: Why You Still Need a VPN for small businesses

In 2025, firewalls and antivirus software alone won’t fully protect your business. SMBs must proactively secure their data, employees, and reputations. Implementing a VPN is among the most effective, immediate, and affordable security upgrades you can make.

Remote WorkForce VPN specifically addresses the unique challenges faced by small businesses. It’s secure, fast, easy to use, and scales as your company grows.

Don’t wait until a cyberattack hits. Let us help you protect your business today.