by Brian Thompson | Mar 13, 2024 | Identity Theft, Mortgage

Enhancing Financial Institutions with Identity Protection Services (IDPS) is crucial in the intricate world of financial transactions, especially within mortgage dealings. IDPS serves as a vital line of defense, safeguarding sensitive data and financial exchanges from cyber threats. Below we will explore the crucial role of IDPS in financial services, focusing particularly on the mortgage sector, and demonstrate how they boost security and build customer trust.

The Imperative for Enhanced Security in Financial Services

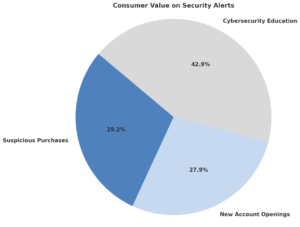

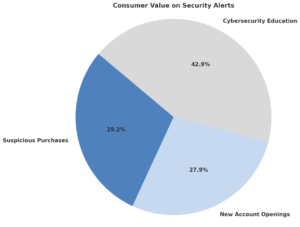

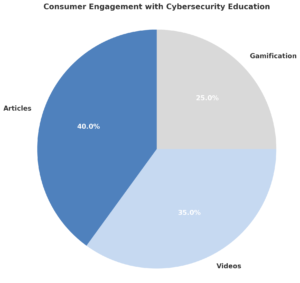

Recent data from Javelin research shows a clear demand for strong security. About 64% of consumers value alerts on suspicious purchases, and 61% like to be informed about new account openings. Yet, a remarkable 94% see the value in cybersecurity education from their FIs. This presents FIs with a great chance to boost trust and engagement. They can do this by offering timely alerts and useful educational content, keeping customers informed and safe from threats.

The Unique Dynamics of Mortgage Transactions

Mortgage transactions, characterized by their high value and sensitivity, present a lucrative target for cybercriminals. The involvement of extensive personal and financial information renders these transactions particularly vulnerable. Implementing IDPS in the mortgage process not only safeguards this sensitive data but also instills a sense of security in consumers, potentially enhancing the customer experience and trust in the financial institution.

Unpacking the Benefits of IDPS for Financial Institutions and Customers: The integration of IDPS offers multifaceted benefits:

- Proactive Threat Detection: IDPS systems enable real-time monitoring and detection of suspicious activities, significantly reducing the risk of data breaches and fraud.

- Enhanced Customer Confidence: With 94% of consumers valuing cybersecurity education, FIs that provide transparent, effective security measures and education can significantly bolster customer trust and loyalty.

- Adaptability to Emerging Threats: IDPS systems are continuously updated to counteract evolving cyber threats, ensuring robust protection for both the institution and its customers.

Financial Institutions Rising to the Challenge:

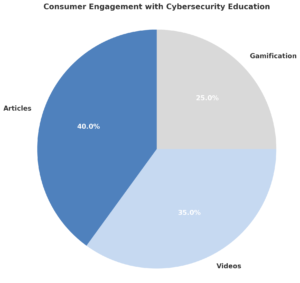

Banks like Truist and Bank of America lead with new security steps. They use virtual assistants and customized alerts. These meet various customer needs. Still, the work isn’t done. Only 14% of big FIs use phone alerts. Few use games to teach about cyber safety. There’s much room for growth.

The Consumer Perspective

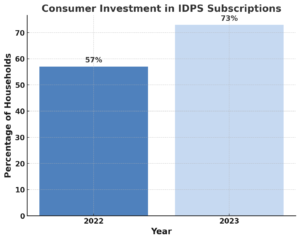

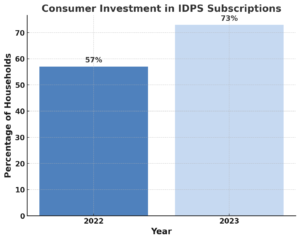

The growing consumer investment in IDPS, especially those including children, from 2022 to 2023 — increasing by 7 percentage points — signals rising awareness and demand for comprehensive family cybersecurity solutions. However, the perception of the necessity for full-family coverage remains low, with 61% of consumers not including children in their IDPS coverage, primarily due to a lack of awareness or underestimation of the risks of child identity theft.

The landscape of financial cybersecurity, particularly within the realm of mortgage services, is evolving rapidly. The role of Identity Protection Services in financial transactions and personal data has never been more critical. Financial institutions must not only adopt and enhance IDPS solutions but also actively educate and engage their customers on the importance of cybersecurity, turning the tide against cyber threats and fostering a safer financial ecosystem.

FAQs:

Q: What role do consumer preferences play in IDPS implementation?

A: Consumer preferences significantly influence the deployment of IDPS. Preferences include varying demands for alert types and communication methods. Tailoring these services to meet customer preferences can enhance engagement and efficacy.

Q: How do IDPS contribute to customer trust?

A: By actively protecting customers from cyber threats and educating them about security practices. IDPS enhances consumers’ confidence in their FIs, fostering stronger customer relationships.

Q: Can IDPS adapt to new types of cyber threats?

A: Yes, IDPS are designed to be dynamic and evolve in response to new cybersecurity challenges. This provides ongoing protection against a spectrum of digital threats.

Articles related to: Enhancing Financial Institutions with Identity Protection Services: A Must for Mortgage Companies

Statistics from Javelin Research

by Brian Thompson | Feb 21, 2024 | Employee Benefits, healthcare, Identity Theft

Guarding Employee Wellness: Why Identity Theft Protection is a Great Option for Business Owners and HR Leaders

In today’s rapidly evolving work landscape, the separation between professional and personal life is becoming increasingly blurred, especially with the increase in remote working. In this newer working environment, employees crave benefits that cater not only to their physical health but also to their financial and emotional wellness. The LIMRA-EY 2023 Workforce Benefits Study brings to light this shift by introducing the Wheel of Wellness, encompassing five key dimensions of wellness: Physical, Mental, Financial, Societal, and Professional 1.

A novel yet pivotal benefit that aligns with multiple facets of the Wheel of Wellness is Identity Theft Protection. Here’s how it dovetails with the five key dimensions:

- Financial Wellness:

Identity theft is no minor issue; it’s a financial slap in the face. The average loss per person is a staggering $3,500. In the United States, total identity theft losses amount to $10.2 billion 2. Offering identity theft protection is a proactive step towards safeguarding an employee’s financial wellness, and ensuring economic resilience, which is a core part of the financial dimension of wellness.

- Mental Wellness:

The ripple effects of identity theft extend beyond financial loss to mental turmoil. The peace of mind from knowing there’s a safety net can be invaluable in promoting mental wellness among employees 3 4. According to the ITRC study, 75% of respondents showed severe distress stemming from the misuse of their information, leading many to seek professional help to navigate their identity theft ordeal—whether it entailed consulting a doctor for physical symptoms or engaging in mental health counseling.

- Professional Wellness:

The time and focus consumed in resolving identity theft issues can impede professional performance. By offering identity theft protection, employers show a proactive stance in supporting their employees’ career development and performance, aligning with the Professional dimension of wellness.

- Societal and Physical Wellness:

While these dimensions may not seem to have a direct link to identity theft protection, a comprehensive approach to employee wellness fosters a conducive environment for societal engagements and physical wellness.

The Stark Reality

A substantial number of Americans are living on the financial edge. Recent surveys reveal that a third of Americans have $100 or less in their savings account going into 2023 6, and many cannot cover a $1,000 emergency 7. This precarious financial situation underscores the necessity of identity theft protection as a part of employee benefits.

Incorporating Identity Theft Protection acts as a barrier against financial distress. Additionally, it contributes to the mental and professional well-being of employees. This benefit’s ripple effect resonates through the Wheel of Wellness. It creates a holistic protective shield around employees. For business owners or HR leaders, including identity theft protection in your benefits is a forward-thinking step. It nurtures a well-rounded, satisfied, and productive workforce. In a fiercely competitive talent market, offering this comprehensive benefit can bolster your employer brand. It makes you a preferred choice among top talents.

As the terrain of work continues to morph, adapting your benefits package to include identity theft protection is not merely about staying current; it’s about fostering a culture of comprehensive wellness and showing a genuine interest in the multifaceted well-being of your workforce.

Ready to arm your employees against identity theft and enhance their overall wellness? Click here to request a comprehensive Identity Theft Protection Employer Response Plan. Your employees will thank you for it!

Related:

by Brian Thompson | Feb 7, 2024 | Employee Benefits, Identity Theft

Personal information is as valuable as currency, so protecting oneself from identity theft is crucial. With cybercriminals becoming increasingly sophisticated, simply hoping for the best is like leaving your front door wide open. But with so many identity theft protection services out there, how do you pick the right lock and camera for your digital doorway? This guide isn’t just about How to Choose the Best Identity Theft Protection Service for You.

Imagine walking through Times Square, your wallet visibly bulging with cash. In the digital world, that’s exactly what you’re doing without proper identity theft protection. This guide is about sifting through the vast and sometimes murky waters of online security Marketing. There are some apples and orange scenarios but it’s usually a variation of the orange you need to be aware of.

The Essentials of Identity Theft Protection

At its core, identity theft protection monitors personal information in credit reports, public records, and online spaces to alert you of potential fraud. Services range from basic credit monitoring to robust plans including fraud resolution support and up to $1 million in identity theft insurance. Yet, as cyber threats evolve, so should our defenses. Comprehensive digital security tools like antivirus software, VPNs, and password managers are becoming indispensable in the fight against identity theft.

Evaluating Your Needs

Before diving into the sea of services, take a step back and assess your digital footprint. Are you a casual internet user or a digital nomad living online? Do you frequently shop or bank online? Understanding your habits and exposure can help pinpoint what protections are most pertinent. Ask yourself what scares you more: the thought of someone opening a credit card in your name or the realization that your personal photos and conversations could be leaked? This introspection is your compass in choosing the right service.

Comparing Services: Beyond the Brand

In the world of identity theft protection, differentiation is often muddled by similar marketing promises, making everything appear equally effective. However, this uniformity is a facade. Many insurance carriers, for example, tout “identity theft protection” as part of their offerings, but a closer look may reveal a watered-down version of protection. These versions often lack comprehensive monitoring, digital security tools, and robust fraud resolution services, focusing instead on post-theft insurance without preventative measures. It’s a bit like offering an umbrella that can only be opened once the rain has stopped – helpful, but not quite what you need when the storm hits.

This highlights the importance of digging deeper than flashy marketing. True protection encompasses both mitigation and resolution, offering protection before the attack and a place to turn if needed. When evaluating services, ask pointed questions about the specifics of their monitoring capabilities, the extent of their insurance coverage, and how they support you in fraud resolution. Remember, when it comes to safeguarding your identity, the quality matters.

Big names might catch your eye, but the devil’s in the details. Look past the logo to what’s actually on offer. Some services excel at credit monitoring but skimp on digital security measures. It’s akin to having a state-of-the-art lock on a flimsy door. Dive deep into what each plan covers, and scrutinize the fine print for what matters most to you.

Key Features to Look For

Here’s a checklist for your quest:

- Credit and Identity Monitoring: How thorough is the monitoring? Is it just your credit score, or does it include dark web surveillance and social media?

- Fraud Resolution and Insurance: What happens if your identity is stolen? Look for services offering hands-on support in restoring your identity, along with substantial insurance coverage.

- Digital Security Tools: Comprehensive protection isn’t just about monitoring; it’s also about prevention. Services that include or offer discounts on antivirus software, VPNs, and password managers are gold.

- Customer Support: When panic strikes, responsive customer service can be your calming beacon. Ensure the service offers 24/7 support.

Making the Decision on How to Choose the Best Identity Theft Protection Service for You

Balancing cost against features can feel like a high-wire act. Remember, free plans might be tempting, but the level of protection is often proportional to the investment. AND – nothing is free. Think of it as insurance: you’re not just paying for the service but for peace of mind. Take advantage of free trials and money-back guarantees to test the waters before committing.

Your Safety, Your Choice

In the end, choosing the right identity theft protection service boils down to understanding your digital lifestyle and matching it with a service that covers your bases without breaking the bank. It’s about finding that perfect balance between peace of mind and practicality. Remember, in the digital world, your security is your responsibility, but you don’t have to go it alone.

FAQs

- Q: Can identity theft protection services prevent all types of identity theft?

A: While no service can offer a 100% guarantee, a comprehensive protection plan significantly reduces your risk and provides tools and support to minimize the impact should identity theft occur.

- Q: How often should I review my identity theft protection needs?

A: As your digital life evolves, so should your protection. Review your coverage annually or after major life changes, like moving, marriage, or a change in online habits.

- Q: Are digital security tools like antivirus and VPNs really necessary?

A: Absolutely. In today’s interconnected world, these tools form the first line of defense against cybercriminals, protecting your personal information from being compromised in the first place.

Additional Thoughts

In a world brimming with digital threats, choosing the right identity theft protection service is more than a convenience—it’s a necessity. Arm yourself with knowledge, and make the choice that best fits your digital footprint. After all, in the fight against identity theft, being proactive isn’t just smart; it’s essential.

Protecting Your Employees, Too:

Employers, it’s your responsibility to protect not just your business but also your employees from identity theft. That’s why we’ve created the Employer Identity Theft Plan. This comprehensive guide provides valuable strategies and steps to take if an employee’s identity is stolen.

Employers, it’s your responsibility to protect not just your business but also your employees from identity theft. That’s why we’ve created the Employer Identity Theft Plan. This comprehensive guide provides valuable strategies and steps to take if an employee’s identity is stolen.

Download the Plan Now to ensure you’re prepared to assist your employees in protecting their identities. Equip yourself with the knowledge and resources to handle such incidents effectively and maintain a secure workplace environment.

Articles related to How to Choose the Best Identity Theft Protection Service for You:

by Brian Thompson | Jan 31, 2024 | Breach, Identity Theft

Businesses and organizations take note! The “Mother Of All Breaches,” involving an unprecedented 26 billion records, isn’t just a personal concern; it’s a corporate crisis. This breach, compromising data from major platforms, poses serious risks to both individual users and organizations. Dive into our mother of all breaches business data security tips.

Understanding the Breach: A Business Perspective

This isn’t just about leaked emails and passwords. The “Mother Of All Breaches” is a complex aggregation of multiple incidents, presenting a unique challenge for businesses. The breach’s vast scope means sensitive employee data could be at risk, leading to potential identity theft or financial fraud. Companies need to recognize the gravity of the situation and act swiftly to safeguard their data and support their employees.

Mother Of All Breaches business data security tips – Immediate Actions

For Employers: Ensure your team is aware of the breach. Encourage them to use tools like Have I Been Pwned to check their data status. For accounts with compromised credentials, enforce immediate password changes. Emphasize the necessity of unique passwords and the adoption of two-factor authentication across all work-related platforms.

Password Strength: A strong password is a blend of letters (both uppercase and lowercase), numbers, and symbols. For example, ‘Coffee_Mug123!’ is better than ‘coffee123’. Avoid using easily guessable information like birthdays or common words.

Long-Term Data Security Strategies

A robust approach to password management is non-negotiable. Encourage the use of password managers for generating and storing complex passwords. Regularly monitor company accounts for unusual activities and educate your employees on recognizing phishing attempts and other cyber threats.

Broader Implications for Companies

Responsibility: It’s not just about technical defenses; it’s about a culture of cybersecurity awareness. Regular training sessions and updates on data security policies are essential. Businesses must also stay abreast of global data protection regulations to ensure compliance and safeguard against breaches.

Securing Our Digital Future

The “Mother Of All Breaches” is a wake-up call for businesses and individuals alike. It’s a reminder that in our interconnected digital world, the responsibility for data security is shared. By fostering a culture of cybersecurity mindfulness and implementing proactive strategies, we can safeguard our collective digital future.

FAQs for Businesses:

- What are the first steps a company should take after a breach?Immediately check if company or employee data is involved, enforce password updates, and review security protocols.

- How can businesses educate their employees about cybersecurity? Regular training sessions, updates on cybersecurity best practices, and encouraging a culture of vigilance are key.

- What are the long-term implications of such breaches for businesses? Potential risks include reputational damage, financial losses, and legal implications due to non-compliance with data protection laws.

Articles/linkes related to mother of all breaches business data security tips:

by Brian Thompson | Dec 6, 2023 | Identity Theft

The holiday season is upon us, and with it comes a joyous flurry of shopping, gifting, and festive cheer. But amidst the twinkling lights and carols lurks a potential Grinch: identity theft. This year, protect your holiday spirit and your finances with this essential guide to holiday shopping identity theft protection.

Beware the Online Shopping Wolves:

Imagine finding the perfect gift online, only to discover it’s a trap! Online shopping scams are the reigning champions of holiday fraud, disguised as fake marketplaces and shady payment methods. Don’t fall for those tempting “too-good-to-be-true” deals – they’re often bait for unsuspecting shoppers.

Fortify Your Digital Kingdom:

Your passwords are the keys to your online castle. Treat them like precious treasure. Craft unique, complex passwords for every account, especially those linked to your finances. And don’t forget two-factor authentication – it’s like having a digital bodyguard keeping watch over your information.

Unmask the Silent Data Snatchers:

Ever heard of skimming? These tiny devices, planted on ATMs and card readers, silently steal your card information. Be vigilant! Choose contactless payment options whenever possible, and keep an eye on your surroundings when using public card readers.

Avoid the Hacker’s Playground:

Public Wi-Fi might seem convenient, but it’s also a haven for hackers. Avoid using public Wi-Fi for shopping or accessing sensitive information. Remember, convenience shouldn’t come at the cost of security.

Don’t Trust the Wolves in Sheep’s Clothing:

Scammers are masters of disguise, often posing as legitimate job opportunities or charitable organizations. Always double-check the authenticity of any request before donating or applying for work. Remember, if something sounds too good to be true, it probably is.

Consumer Concerns: A Holiday Shopping Reality Check:

A whopping three-quarters of you worry about data breaches while holiday shopping, and with good reason. The number of concerned shoppers is at an all-time high. It’s not just paranoia – it’s a necessary precaution in today’s digital world.

Transform Yourself into a Security Ninja:

Become a savvy shopper with these essential tips:

- Verify online stores and charities before clicking.

- Use secure payment methods like credit cards with strong fraud protection.

- Monitor your account statements regularly – early detection is key.

Holiday Cheer without the Fear:

Don’t let the fear of identity theft dampen your holiday spirit. By following these simple guidelines, you can navigate the holiday shopping maze with confidence and joy. Remember, awareness is your best defense. So, stay vigilant, stay safe, and enjoy a scam-free holiday season!

Spread the Word:

Share this guide with your loved ones and help them protect themselves from holiday scams. For more financial fitness tips, subscribe to our blog.

Let’s toast to a happy, safe, and scam-free holiday season!

Articles related to holiday shopping identity theft protection

by Brian Thompson | Nov 15, 2023 | Identity Theft

The excitement of Black Friday is just around the corner, and while it’s a great time to score amazing deals, it’s also a time when cybercriminals are particularly active, preying on unsuspecting shoppers. This comprehensive guide will equip you with the knowledge and tools to safeguard your personal information and enjoy a secure Black Friday shopping experience. B

1. Beware of Phishing Scams: Identify and Avoid Malicious Emails

Phishing scams are a common tactic used to trick unsuspecting individuals into revealing sensitive information, such as passwords, credit card details, or Social Security numbers. These emails often masquerade as legitimate communications from well-known companies or organizations, making them difficult to spot.

Here are some red flags to watch out for to identify phishing scams:

-

Account Verification Scams: Emails claiming a need to update your account information due to a hacking attempt or other security breach are likely phishing attempts. Genuine companies will never ask for sensitive details via email.

-

Order Confirmation and Billing Error Scams: Be cautious of emails about unexplained orders or billing issues. These emails often lead to fraudulent sites designed to steal your credit card information.

-

Delivery Scams: Ignore texts or emails with fake delivery notices or tracking numbers. These scams aim to lure you into clicking on malicious links or downloading malware.

2. Spotting Legitimate Deals: Exercise Caution and Verify Authenticity

In the frenzy of Black Friday sales, it’s easy to fall prey to scams. Here are some tips to spot genuine deals and avoid fraudulent ones:

-

Too Good To Be True: If a deal appears unrealistically low, it probably is. Exercise caution and verify the deal’s authenticity by checking the retailer’s official website or contacting their customer service team.

-

Personal Information Requests: Genuine companies will never ask for sensitive details, such as passwords or credit card information, through insecure means like email. If you receive such a request, it’s a clear indication of a scam.

-

Website Security: Ensure the website you’re shopping on uses encrypted connections, indicated by “https://” and a padlock symbol in the address bar. This ensures that your data is transmitted securely and protected from eavesdropping.

3. Utilizing Trusted Security Tools: Fortify Your Online Defense

Technology can be a powerful ally in safeguarding your identity online. Here are some essential security tools to consider incorporating into your online shopping routine:

-

Strong Security Software: Opt for reputable antivirus and anti-malware software to protect your device from malicious software and ransomware. Keep your software up to date to ensure the latest protection against evolving threats.

-

Virtual Private Networks (VPNs): Hide your IP address and location for secure browsing and prevent cyber criminals from tracking your online activity. This is especially useful when using public Wi-Fi networks, which are often unsecured.

-

Password Managers: Use tools that help you create and manage strong, unique passwords for each online account. Never reuse passwords across different sites, as this makes you more vulnerable to credential-stuffing attacks.

-

Ad Blockers: Employ ad blockers to avoid malicious pop-ups, scripts, and third-party tracking cookies. These can not only be annoying but can also potentially expose you to malware or redirect you to fraudulent sites.

-

Mobile Security Apps: Protect your smartphone from phishing sites and ensure secure online transactions, especially when shopping on the go. Many mobile security apps offer real-time protection and can block suspicious websites or prevent malicious downloads.

4. Immediate Actions if Compromised: Swift Response to Protect Your Identity

If you suspect your identity has been compromised, take immediate action to minimize the potential damage and protect your financial accounts:

-

Contact Your Bank: Immediately report any unauthorized transactions on your bank accounts or credit cards to prevent further losses. This will also allow your bank to take steps to protect your account and investigate the fraudulent activity.

-

Report to Authorities: Notify fraud reporting centers and law enforcement, especially if you believe your identity has been stolen for fraudulent purposes. This will help in tracking down the perpetrators and preventing future scams.

Stay Vigilant and Shop Securely

Black Friday is an excellent opportunity to find amazing deals, but it’s also a prime target for cybercriminals. By staying alert, employing these strategies, and utilizing the right security tools, you can enjoy the shopping spree without compromising your identity. Remember, the key to safe shopping is vigilance, caution, and the right use of technology.

Related Articles: