by Brian Thompson | Aug 2, 2023 | Employee Benefits, Identity Theft

In the evolving landscape of employee benefits, one crucial aspect often remains overlooked: identity theft protection. Employers are striving to provide comprehensive benefits packages that cater to the diverse needs of their workforce. BUT, Identity theft protection is an offering that has yet to receive the attention it truly deserves. There are 4 reasons agents don’t offer identity theft protection.

Below are the four most common objections we hear, keeping identity theft protection from benefits conversations. We unravel the layers of misconception and reveal reasons why identity theft protection should be in every company’s benefits portfolio. From debunking cost concerns to showcasing the tangible advantages for both employers and employees, we’ll illuminate how identity theft protection not only shields against financial turmoil but also nurtures a culture of trust and security within the workplace.

4 Objections

- Cost: While it’s true that identity theft protection can come with a cost, it’s important to consider the potential long-term savings. (defend-id Plans overview – it might be less expensive than you think) In the unfortunate event of a data breach or identity theft incident affecting employees, the costs can skyrocket due to legal fees, reputational damage, and employee downtime. By investing in identity theft protection as an employee benefit, companies proactively mitigate these potential financial burdens. Plus, the cost of offering this benefit is outweighed by improved employee morale, loyalty, and overall productivity.

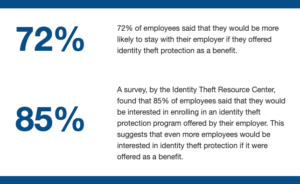

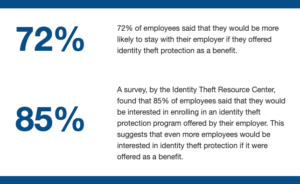

Lack of Demand: It’s understandable to have concerns about demand, but identity theft is a pervasive and growing issue impacting millions of employees yearly. Even if employees haven’t expressed an interest in identity theft protection, it doesn’t mean they wouldn’t value the added security and peace of mind. Offering this benefit demonstrates your commitment to their well-being and financial security. Additionally, proactive education about the risks of identity theft could help employees recognize its importance and drive demand over time. Here are statistics by the Identity Theft Resource Center showing a clear demand for the benefit:

Lack of Demand: It’s understandable to have concerns about demand, but identity theft is a pervasive and growing issue impacting millions of employees yearly. Even if employees haven’t expressed an interest in identity theft protection, it doesn’t mean they wouldn’t value the added security and peace of mind. Offering this benefit demonstrates your commitment to their well-being and financial security. Additionally, proactive education about the risks of identity theft could help employees recognize its importance and drive demand over time. Here are statistics by the Identity Theft Resource Center showing a clear demand for the benefit: - Limited Knowledge: Identity theft protection is increasingly relevant in today’s digital world. Taking the time to familiarize yourself with reputable identity theft protection providers and their features will not only enhance your credibility but also allow you to tailor solutions that best fit your client’s needs. Partnering with knowledgeable providers can also provide the necessary support to address any questions or concerns you may have.

- Concerns about Privacy: Privacy is a valid concern, but reputable identity theft protection providers prioritize data security and confidentiality. When partnering with established providers, you can assure your clients that stringent measures are in place to safeguard sensitive information. Offering identity theft protection can be an opportunity to educate employees about the importance of secure data handling and protection practices. Clear communication about how their data will be used and secured can help alleviate concerns and build trust.

Identity theft protection is a valuable benefit that employers should consider offering to their employees.

It can help to protect employees from the financial and emotional harm of identity theft, and it can also save employers money in the long run.

Cost, lack of demand, limited knowledge, and concerns about privacy are all valid concerns, but they can be overcome. By partnering with a reputable identity theft protection provider, employers can ensure that their employees’ data is secure and that they have access to the resources they need to protect themselves from identity theft.

Offering identity theft protection is a way to show employees that you care about their well-being and financial security. It is also a way to protect your company from the financial and reputational damage caused by an identity theft incident.

If you are an employer, I encourage you to consider offering identity theft protection as a benefit to your employees. It is a wise investment that can protect your employees and your company.

Related Articles

by Brian Thompson | Jul 20, 2023 | General

The rapid shift to remote work brought on by the COVID-19 pandemic has fundamentally changed the way we work and interact online. While remote work has provided many benefits, it has also exposed a significant vulnerability. Over 75% of Remote Workers Don’t Use a VPN creating risk in the form of cybersecurity.

In a recent survey highlighted by TechRadar, it was found that a staggering 88% of remote workers do not use a Virtual Private Network (VPN) while carrying out their work tasks. This alarming statistic raises concerns about the potential heat wave of cyber threats that may hit this summer.

In this article, we will delve into the importance of VPNs, the risks associated with remote work without one, and practical steps to ensure a secure work environment.

Understanding VPNs and their Importance

A Virtual Private Network (VPN) like Remote WorkForce creates an encrypted connection between a user’s device and the internet, providing a secure pathway for data transmission. By routing internet traffic through a remote server, VPNs shield online activities from prying eyes and potential cyber threats.

This encryption technology safeguards sensitive information, such as login credentials, financial data, and proprietary company information, from falling into the wrong hands.

Remote WorkForce VPN automatically routes the request directly to the requested resource, regardless of where it is located, via a secure tunnel established for that user.

The Risks of Remote Work

Without the protection of a VPN like Remote WorkForce, remote workers are more susceptible to various cyber threats. Here are some of the risks they face:

- Data Interception: Public WiFi networks, commonly used in cafes, airports, or hotels, are notorious for their lack of security. Hackers can easily intercept data transmitted over these networks, potentially gaining access to usernames, passwords, and other confidential information.

- Man-in-the-Middle Attacks: In a man-in-the-middle attack, an attacker secretly relays and possibly alters the communication between two parties. This enables them to intercept sensitive information exchanged between remote workers and their company’s servers, posing a serious threat to data integrity and confidentiality.

- Phishing Attacks: Phishing emails and websites are a common method used by cybercriminals to trick users into revealing sensitive information. Without a VPN, remote workers are more susceptible to falling victim to these attacks, which can result in identity theft, financial loss, or unauthorized access to company systems.

- Malware Infections: Remote workers who connect directly to the internet without the protection of a VPN like Remote WorkForce are at a higher risk of downloading malware. Malicious software can compromise the security of both personal and company devices, leading to data breaches and system malfunctions.

Ensuring a Secure Work Environment

To mitigate the risks associated with remote work, it is crucial for organizations and individuals to adopt secure practices. Here are some practical steps to establish a secure work environment:

- Educate and Raise Awareness: Organizations should provide comprehensive training on cybersecurity best practices to remote workers. This includes the importance of using a VPN like Remote WorkForce, recognizing phishing attempts, and following secure password protocols. Regular reminders and updates can help employees stay vigilant and informed.

- Implement a VPN Policy: Companies should establish a clear policy mandating the use of VPNs for all remote workers. This policy should outline the consequences of non-compliance and provide guidelines for selecting and configuring VPN software.

- Use Multi-Factor Authentication (MFA): Enforcing the use of MFA adds an extra layer of security by requiring users to provide multiple forms of authentication, such as a password and a unique code sent to their mobile device. This greatly reduces the risk of unauthorized access, even if passwords are compromised.

- Secure Remote Access: Remote workers should ensure that their home WiFi network is encrypted and password protected. Regularly updating router firmware and changing default login credentials is crucial to prevent unauthorized access to their network.

- Regular Software Updates: Keeping devices and software up to date is vital for security. Remote workers should regularly install updates and patches for their operating systems, applications, and antivirus software to stay protected against the latest vulnerabilities.

Use a VPN Like Remote WorkForce to Stay Safe

The TechRadar survey revealing that 88% of remote workers do not use a VPN highlights the urgent need to address cybersecurity vulnerabilities in the remote work environment. As the summer months approach, the risks of cyber threats loom large.

By understanding the importance of VPNs, recognizing the risks of remote work without one, and implementing secure practices, both organizations and remote workers can take proactive steps to safeguard sensitive information and maintain a secure work environment.

Some SMBs need an even more robust solution, so we developed Remote WorkForce ZTN. In addition to providing VPN capabilities, Remote WorkForce ZTN provides end-to-end encryption for all IT resources, without requiring back-hauls through the LAN for resources in the cloud. Routing to the appropriate network is handled automatically, simplifying access for users. Remote WorkForce ZTN provides a true Zero Trust layer on top of our VPN. Employees only have access to IT resources that they are specifically authorized to use. Other corporate resources are not even visible and any unauthorized attempts to access them are blocked.

Let’s embrace the benefits of remote work while staying vigilant against the rising tide of cyber threats by using a VPN/ZTN solution like Remote WorkForce.

Related Articles:

by Brian Thompson | Jul 5, 2023 | Identity Theft

Summertime is a great time to travel, but it’s also a prime time for identity theft. Vacationers are often more relaxed and less vigilant about their personal information, making them easy targets for thieves. Don’t forget to protect yourself from identity theft while you’re away. Identity theft can happen anywhere, including while you’re on vacation. But with a few simple precautions, you can enjoy your trip without worrying about your personal information falling into the wrong hands. Keep reading to learn more about protecting your identity while traveling and get tips for a secure vacation.

Secure your personal documents.

Before you leave for your vacation, make sure to secure your personal documents. This includes your passport, driver’s license, and any other identification cards you may be carrying. Keep these documents in a secure location, such as a hotel safe or a locked suitcase. Avoid carrying unnecessary documents with you, and if you need to bring them, make sure to keep them hidden and out of sight. By taking these precautions, you can minimize the risk of your personal information being stolen while you’re traveling.

Use a VPN when accessing public Wi-Fi.

When you’re traveling and need to connect to public Wi-Fi, it’s important to use a virtual private network (VPN) to protect your identity. Public Wi-Fi networks are often unsecured, making it easy for hackers to intercept your personal information. A VPN creates a secure connection between your device and the internet, encrypting your data and keeping it safe from prying eyes. By using a VPN, you can browse the internet, check your email, and access your online accounts without worrying about your personal information being stolen.

Be cautious with your credit cards.

When traveling, it’s important to be cautious with your credit cards to protect your identity. Avoid using your credit card for purchases at unsecured or unfamiliar locations, as these may be more susceptible to skimming devices or fraudulent activity. Instead, opt for cash or use a secure payment method such as a mobile wallet or chip-enabled card. Additionally, regularly monitor your credit card statements and report any suspicious activity immediately to your credit card company. By taking these precautions, you can enjoy your vacation without the worry of identity theft.

Avoid oversharing on social media.

While it may be tempting to share every detail of your vacation on social media, it’s important to exercise caution. Oversharing can make you a target for identity theft, as criminals can use the information you post to piece together your personal details. Avoid posting your exact travel dates, location, or any other sensitive information that could be used to compromise your identity. Instead, wait until you return home to share your vacation memories. By being mindful of what you share online, you can help protect your identity while traveling.

Keep an eye on your financial statements.

One of the most important steps in protecting your identity while traveling is to regularly monitor your financial statements. This includes checking your bank accounts, credit card statements, and any other financial accounts for any suspicious activity. Look for any unauthorized charges or withdrawals, as these could be signs of identity theft. If you notice anything out of the ordinary, contact your financial institution immediately to report the issue and take steps to protect your accounts. By staying vigilant and keeping an eye on your financial statements, you can help prevent identity theft and enjoy a secure vacation.

Clean out our wallet

Only take the forms of payment you need. If you have your purse or wallet stolen it is easier to remember what cards you have and quicker to limit your exposure.

Check bank accounts and credit cards:

be aware of charges and amounts you have on your accounts and cards. You can also set up alerts to let you know when certain spending or account limits are met.

Use hotel safes

Place anything that has personal information on it that you don’t need in the room safe. This way it isn’t on your person and reduces the risk of it being lost.

Protect your phone

it seems like we should not have to say this but if you do not have a password or biometrics on your phone, set it up before you go

Identity theft can happen anywhere, even on vacation. While there is no foolproof way to prevent it, following these tips can help you reduce your risk of identity theft while on vacation. However, it’s important to remember that there is no foolproof way to prevent it. If you think you’ve been a victim of identity theft, contact your bank, credit card companies, and the Federal Trade Commission (FTC) immediately.

Articles related to: Protecting Your Identity While Traveling: Tips for a Secure Vacation

by Brian Thompson | Jun 29, 2023 | Identity Theft

Your credit report plays a crucial role in your financial well-being, and errors on it can have a significant impact. If you’re concerned about inaccuracies on your credit report, this guide will provide you with step-by-step instructions on how to identify and dispute any errors. By taking control of your credit, you can ensure that your financial information is accurate and protect your overall financial health. Continue reading to learn what you need to know about errors on your credit report.

Understand the Importance of Checking Your Credit Report Regularly.

Checking your credit report regularly is essential for maintaining good financial health. Errors in your credit report can hurt your credit score and make it harder to get loans or credit cards. By reviewing your credit report on a regular basis, you can identify any inaccuracies or fraudulent activity and take the necessary steps to correct them. Don’t wait until you’re in a financial bind to check your credit report; make it a habit to review it at least once a year to ensure its accuracy and protect your financial future.

Review Your Credit Report for Errors and Inaccuracies.

One of the most important steps in maintaining good financial health is to regularly review your credit report for errors and inaccuracies. These errors have a negative impact on your credit score. Low credit scores make it difficult for you to obtain loans or credit cards with favorable interest rates. By taking the time to review your credit report, you can identify any mistakes or fraudulent activity. Then you can take necessary steps to dispute and correct them. Don’t wait until you’re in a financial bind to check your credit report – make it a habit to review it at least once a year to ensure its accuracy and protect your financial future.

Gather Supporting Documentation to Dispute Errors.

When disputing errors on your credit report, it’s important to gather supporting documentation to strengthen your case. This documentation can include things like bank statements, payment receipts, and correspondence with creditors. By providing evidence to support your dispute, you increase your chances of having the error corrected. Keep in mind that it’s important to keep copies of all documentation for your records and to send copies, not originals, when submitting your dispute. Taking the time to gather supporting documentation can make a significant difference in the outcome of your dispute and help you take control of your credit.

Submit a Dispute to the Credit Reporting Agency.

Once you have identified an error on your credit report, the next step is to submit a dispute to the credit reporting agency. This can be done online, by mail, or by phone, depending on the agency’s preferred method. When submitting your dispute, be sure to include all relevant information, such as the specific error you are disputing and any supporting documentation you have gathered. It’s important to be clear and concise in your dispute, and providing all details needed to investigate and correct the error. The credit reporting agency must investigate your dispute within 30 days and respond. If the agency determines that the information is indeed inaccurate, they must correct it on your credit report. Take the time to submit a dispute and provide supporting documentation to take control of your credit and ensure that your credit report is accurate and up-to-date.

Follow Up and Monitor the Resolution of Your Dispute.

After submitting a dispute to the credit reporting agency, it’s important to follow up and monitor the resolution of your dispute. Keep track of the date you submitted the dispute. Make a note to follow up after the designated timeframe for investigation has passed. If you haven’t received a response within the specified timeframe, reach out to the agency to inquire about the status of your dispute. It’s also a good idea to regularly check your credit report to see if the error has been corrected. You can request a free copy of your credit report from each of the three major credit reporting agencies once a year.By staying proactive and tracking your dispute, you can ensure that inaccuracies on your credit report are addressed and corrected quickly.

Summarized

Errors on your credit report can have a significant impact on your financial well-being. By following the steps outlined in this article, you can take control of your credit and ensure that your financial information is accurate.

- Review your credit report regularly. This is the most important step in preventing errors from occurring.

- Gather supporting documentation to dispute any errors you find.

- Submit a dispute to the credit reporting agency. Be clear and concise in your dispute, and provide all relevant information.

- Follow up and monitor the resolution of your dispute. Don’t let the issue go unresolved.

By taking these steps, you can protect your financial future and ensure that your credit report is accurate.

Here are some additional tips for disputing errors on your credit report:

- Be sure to dispute the error within 30 days of discovering it.

- If you are disputing a debt, be sure to provide proof that you have paid it in full.

- Disputing an account that you do not recognize? Be sure to provide proof that you are not the account holder.

- Be persistent in following up with the credit reporting agency.

By following these tips, you can increase your chances of having your error corrected. If you have any questions on what you need to know about errors on credit report contact us here: https://www.defend-id.com/contact

Stay safe and think before you click!

Related articles:

by Brian Thompson | Jun 20, 2023 | Identity Theft

As a mortgage borrower, identity theft protection is something that should be on your radar. With so much personal and financial information exchanged during the mortgage process, it’s important to know why identity theft protection is crucial for mortgage borrowers and to take steps to protect yourself from fraud and identity theft.

Here are some tips to help you secure your identity during the mortgage process and beyond.

- Work with a reputable lender or mortgage broker. Do your due diligence and research any professionals you’re considering working with. Read reviews, ask for referrals from friends and family, and check their credentials.

- Be careful about who you share your personal information with. When filling out mortgage applications or providing financial information, be careful about who you share it with. Never give out personal or financial information to someone who contacts you unsolicited. If you receive a call or email requesting this information, hang up or delete the message and contact your lender or broker directly to verify the request.

- Consider using a credit monitoring service. Consider using a credit monitoring service to keep tabs on your credit report and alert you to any suspicious activity. This can be especially helpful during the mortgage process, when your credit report may be pulled multiple times.

- Freeze your credit report. Another option to consider is freezing your credit report. This prevents anyone from opening new accounts in your name without your permission. Keep in mind that this can also make it more difficult for you to open new accounts, so weigh the pros and cons before taking this step.

- Monitor your financial accounts and credit reports regularly. Finally, be vigilant about monitoring your financial accounts and credit reports even after your mortgage has closed. Set up alerts for any activity on your accounts and regularly check your credit report for any errors or fraudulent activity.

- Ask your lender if they provide identity theft protection during the process and or after as a borrower benefit.

Identity theft is a serious problem, but it can be prevented. By taking these steps, you can help protect your identity and your financial future.

Here are some additional tips to help protect your identity:

- Use strong passwords and change them regularly.

- Be careful about what information you share online.

- Shred or destroy any documents that contain your personal information before you throw them away.

- Be aware of phishing scams.

- Report any suspicious activity to your lender or the credit bureaus immediately.

Protecting your identity may seem like a hassle, but it’s an important step to take to safeguard your finances and personal information. By taking these steps and staying vigilant, you can help prevent identity theft and enjoy a more secure financial future.

Did you know?

- Identity theft is a crime that affects millions of people every year.

- The average victim of identity theft spends 200 hours and $1,200 to recover their identity. FTC

- You can freeze your credit report for free at each of the three credit bureaus.

Related articles:

Lack of Demand: It’s understandable to have concerns about demand, but identity theft is a pervasive and growing issue impacting millions of employees yearly. Even if employees haven’t expressed an interest in identity theft protection, it doesn’t mean they wouldn’t value the added security and peace of mind. Offering this benefit demonstrates your commitment to their well-being and financial security. Additionally, proactive education about the risks of identity theft could help employees recognize its importance and drive demand over time. Here are statistics by the Identity Theft Resource Center showing a clear demand for the benefit:

Lack of Demand: It’s understandable to have concerns about demand, but identity theft is a pervasive and growing issue impacting millions of employees yearly. Even if employees haven’t expressed an interest in identity theft protection, it doesn’t mean they wouldn’t value the added security and peace of mind. Offering this benefit demonstrates your commitment to their well-being and financial security. Additionally, proactive education about the risks of identity theft could help employees recognize its importance and drive demand over time. Here are statistics by the Identity Theft Resource Center showing a clear demand for the benefit: