by Brian Thompson | Feb 15, 2023 | healthcare, Identity Theft

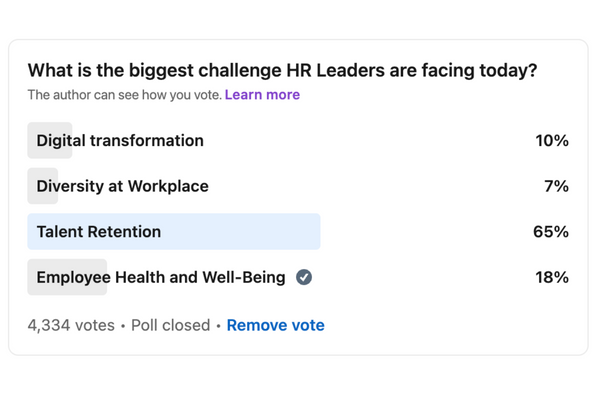

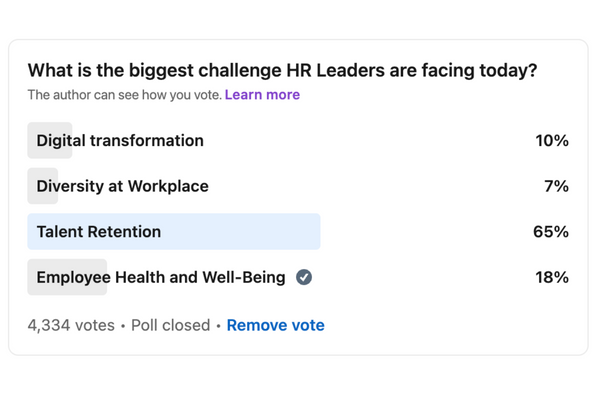

A recent poll asked, “what are the biggest challenges facing HR leaders today”. Given the size of the poll, done on LinkedIn within the Human Resources (HR) Professionals page we thought it would be worth considering and sharing. (worth considering: 1, 2, and 4 may all impact number 3)

The Poll

- According to a poll of 4,334 professionals, talent retention was identified as the top concern by 65% of respondents. Retaining top talent is crucial to the success of any organization, as losing valuable employees can be costly in terms of productivity, morale, and revenue.

- Diversity in the workplace was only a concern for 7% of respondents. While this is a concern very much talked about it is the lowest concern based on the survey.

- The use of technology is increasingly relevant in the workplace. Digital transformation is a concern for 10% of HR professionals surveyed. HR leaders must adapt and leverage new digital tools to stay competitive and efficient in the workplace.

- Employee health and well-being came in at 18%, the second biggest challenge according to HR professionals. HR professionals have a vested interest in promoting employee health and well-being. Focusing on health and wellness can lead to; improved productivity, decreased absenteeism, and increased employee retention. Additionally, demonstrating concern for employee well-being can help build a positive and supportive workplace culture and can have financial benefits for an organization.

Employee benefits

Employee benefits play a vital role in enhancing employee retention, well-being, and productivity. Identity theft protection, in particular, is a critical benefit that should be considered in all four areas mentioned in the poll. Identity theft can impact an employee’s financial well-being, health, and work productivity, and offering identity theft protection can help mitigate these effects. Furthermore, it can enhance digital transformation efforts. If their data is secure, employees will feel more comfortable adopting new digital tools.

There are several challenges facing HR leaders, with talent retention being the most pressing. Nonetheless, diversity in the workplace, employee health and well-being, and digital transformation can also contribute to employee retention and organizational success. HR can enhance employee well-being and improve overall effectiveness by offering employee benefits such as identity theft protection.

Related articles:

by Brian Thompson | Jan 20, 2023 | healthcare, Identity Theft

Life insurance fraud is a criminal act in which an individual or group of individuals intentionally deceives an insurance company in order to receive a financial benefit or payout from a life insurance policy. This can occur in a variety of ways, from exaggerating or fabricating claims on a policy to providing false information in order to obtain coverage.

Examples of life insurance fraud include:

- Policyholder fraud: This occurs when the policyholder provides false information on a life insurance application in order to obtain coverage, such as exaggerating their health status or providing a false occupation.

- Beneficiary fraud: This occurs when a beneficiary of a life insurance policy makes false claims in order to receive a payout, such as fabricating the cause of death or providing false documentation.

- Agent fraud: This occurs when an insurance agent engages in fraudulent activity, such as selling policies to individuals who do not qualify for coverage or falsifying policy applications.

- Premium diversion: This occurs when an insurance agent takes premium payments from policyholders but does not use the funds to pay for the policy, instead using the money for personal gain.

To avoid falling victim to scams, here are a few steps to take:

- Research the insurance company and agent before purchasing a policy. Check for any complaints or disciplinary actions against them with the state insurance commissioner.

- Be wary of unsolicited phone calls or emails offering life insurance policies.

- Carefully review all policy documents before signing, and ask questions if anything is unclear.

- Pay attention to billing and payment schedules, and report any discrepancies to the insurance company immediately.

If you suspect that you are a victim of life insurance fraud, you should report it to the insurance company immediately. You should also contact the state insurance commissioner and file a complaint with the National Association of Insurance Commissioners. Additionally, you may want to contact the police to report the crime.

by Brian Thompson | Nov 16, 2022 | healthcare, Identity Theft

If you or someone you love is on Medicare, or if you are an agent selling Medicare, you are likely reviewing and comparing options now. As you are shopping to select the plan that is right for you or your client, know that scammers are impersonating Medicare agents.

Scammers may appear credible, claim to be from Medicare, and possess your personal information. The truth is that they’re actually attempting to steal your identity, money, or Medicare information. Following are some tips on how to recognize potential scams:

- The name displayed on your phone may be fake. Scammers can fake a caller ID.

- If a caller requests your Medicare, Social Security, bank, or credit card information, hang up. Legitimate Medicare employees have your Medicare number on file.

- Take your time; don’t be rushed into anything. Medicare doesn’t provide additional benefits for early enrollment, and you have until December 7 to complete the process.

- Threats to take away your benefits are not legitimate. Benefits that you are eligible for cannot be terminated because you chose not to enroll in a plan.

- Never engage in conversation with anyone who claims that Medicare prefers their plan. Medicare doesn’t endorse a specific plan.

- Get help to deal with Medicare fraud and abuse at smpresource.org.

To report someone pretending to be affiliated with Medicare and other Medicare scams, call 1-800-MEDICARE (800-633-4227) and tell the FTC at ReportFraud.ftc.gov. Or if you have a defend-id program, contact our team at 1-800-487-0160.

As the December 7th deadline approaches, take extra precautions to ensure that fraudsters impersonating medicare agents dont take advantage of you or your clients.

Related Articles:

Elderly Identity Theft

SENIOR IDENTITY THEFT TO GET SIGNIFICANTLY WORSE

by Brian Thompson | Jul 20, 2022 | Breach, healthcare, Identity Theft

Do healthcare breaches and Medical ID Theft go hand in hand?

I first want to refer back to an article from about two years ago titled Telehealth Creates Creates Cyber Risks. In the article, I stated that “the COVID-19 pandemic has increased consumer risks through cyber scams and medical identity theft.”

Fast forward one year to August 4, 2021 article titled Healthcare Data Breaches Most-Common Threats to Date in 2021. The article states, “the healthcare sector is once again in the top position as the most breached economic sector” and “healthcare has been at or near the top of the (data breach) chart since at least 2017.”

And again this year, we have seen the trend continue. Hackers hit health companies, insurers with increasing regularity – Inside

But Why Medical Records?

A primary reason ID theft criminals and cyber thieves target healthcare providers is the Electronic Health Record or EHR. EHR is the collection of patient information into a digital record. EHRs significantly improve administrative efficiency and medical proficiency through shared networks and exchanges.

A typical EHR includes

- medical history,

- medications,

- allergies,

- immunizations,

- laboratory test results,

- and radiology images.

Your EHR also includes your

- billing information such as personal information (e.g. date of birth, home address, and Social Security Number),

- insurance information,

- and financial information (e.g. credit card number).

Unfortunately, ID theft criminals and cyber thieves are mostly interested in your personal, insurance, and billing information. For this fact alone, healthcare data breaches continue to be “in the top position as the most breached economic sector.”

Things to Think About

Every health insurance plan you have ever had has your and your family’s Social Security Number (SSN). Almost every healthcare provider (such as a doctor of medicine or osteopathy, podiatrist, dentist, chiropractor, clinical psychologist, optometrist, nurse practitioner, nurse-midwife, or clinical social worker) that you or a family member have been to has your Social Security Number.

So back to the title of this article – Do healthcare breaches and Medical ID Theft go hand in hand? – the answer is a resounding YES based on the Personal Health Information or PHI that is collected, stored, and transferred through your Electronic Health Record.

To make matters worse, this article titled Organization Wide PHI Access is Commonplace at Most Healthcare Orgs reported that “nearly 20 percent of (PHI) files were open to every employee at a given healthcare organization starting on their first day of employment, pointing to troubling data security issues and poor PHI access controls.”

Based on the fact that cyber thieves are stealing healthcare data and are finding new ways to monetize phishing (fraudulent emails), vishing (fraudulent phone calls and voice mail messages) and smishing (fraudulent text messages), consumers need to pay attention to data breach news in general and healthcare data breach news in particular.

To conclude, consumers can also reduce their risk of medical identity theft by safeguarding their health insurance cards, and regularly reviewing credit reports, medical benefit explanations, medical bills, and prescription bills.