by Brian Thompson | Feb 9, 2023 | General, Identity Theft, Uncategorized

As a parent, it’s important to be aware of the potential dangers and harmful content on TikTok, a popular social media platform among children. This guide provides information on TikTok parental controls and the reasons why it may be best to keep children off the app.

TikTok Parental Controls: A Guide for Protecting Children

Concerned parents and authorities need a comprehensive guide on TikTok parental controls to protect children from harmful and inappropriate content on the popular social media platform. This tutorial outlines step-by-step instructions to implement TikTok controls and discusses privacy policies.

- Create TikTok Account: Get started by creating a TikTok account for your child, giving you access to all platform features and settings.

- Enable Digital Wellbeing: Go to “Settings & Privacy” and select “Digital Wellbeing” to enable features such as “Screen Time Management” and “Restricted Mode.” These tools help monitor children’s activity and protect them from harmful content.

- Adjust Privacy Settings: Protect your child’s privacy by visiting “Settings & Privacy” and selecting “Privacy and Safety.” Change who can send direct messages, view videos, and see their profile to the most secure options.

- Report Inappropriate Content: Encourage your child to report any inappropriate or harmful content by using TikTok’s reporting feature.

- Educate Children: Parental controls are important, but so is educating children on online safety and the potential dangers of social media. Teach them to be cautious with information they share, avoid strangers, and report any inappropriate behavior or content.

Regarding privacy policies, TikTok collects information such as location, device information, and usage data. While this data improves user experience, it may raise privacy concerns for parents. To protect children’s privacy, review TikTok’s privacy policy and adjust app privacy settings to limit data sharing.

In conclusion, TikTok parental controls provide a vital way to protect children from harmful and inappropriate content on the app. By creating a TikTok account, enabling digital wellbeing features, adjusting privacy settings, reporting inappropriate content, and educating children, parents can ensure a safe and enjoyable TikTok experience for their kids.

There are several reasons why it may be best to keep children off TikTok. Some of the main concerns include:

- Inappropriate Content: TikTok is known for hosting a vast amount of content that may not be suitable for children. This includes content that is sexually explicit, violent, or promotes harmful ideologies.

- Online Safety: TikTok is a social media platform that can be used by predators to target and exploit children. Children may be at risk of being exposed to inappropriate content, cyberbullying, or may become victims of online grooming.

- Screen Time: TikTok is a highly engaging platform that can quickly consume a lot of a child’s time. Spending too much time on TikTok can lead to decreased physical activity, disrupted sleep patterns, and decreased academic performance.

- Privacy Concerns: TikTok collects and stores personal data from its users, which can raise privacy concerns. Children may not understand the implications of sharing personal information online, and their data could be used for malicious purposes. See TikTok Terms of Service

- Intrusive Policies: TikTok’s privacy policies may be considered intrusive, as the app collects and stores a large amount of personal data from its users. This can raise privacy concerns, particularly for children who are vulnerable.

Considering the potential dangers and harmful content on TikTok, it may be best to keep children off the app. Instead, parents can encourage children to spend their time on other, safer and more appropriate activities.

Protecting children on TikTok requires a combination of parental controls, education, and awareness of the potential dangers. By understanding TikTok’s privacy policies, implementing parental controls, and limiting children’s time on the app, parents can ensure a safe and enjoyable online experience for their kids.

Related Articles:

by Brian Thompson | Feb 8, 2023 | Breach, Identity Theft

Artificial Intelligence (AI) has come a long way, bringing numerous benefits. However, it also has the potential to be used for malicious purposes, especially in social engineering. This article will show you how AI can manipulate people and why it’s crucial to be aware of these tactics to protect your personal information.

What is Social Engineering?

Social engineering manipulates individuals into revealing confidential information or performing actions that benefit the attacker. Attackers use various methods, such as emails, phone calls, or in-person interactions. AI can automate these tactics and make them even more sophisticated.

How AI Manipulates People

AI can manipulate people through voice assistants. AI-powered voice assistants can mimic human voices, making it hard to tell the difference between a human and an AI. This can trick individuals into revealing personal information, leaving them vulnerable to attack. Here is an example story from Knowbe4.

Chatbots are another tool that AI uses for social engineering. Chatbots can hold conversations with individuals, leading them to reveal personal information. People often trust chatbots, thinking they are human, but chatbots can be programmed to manipulate individuals into revealing sensitive information, which attackers can then use for malicious purposes.

Why You Must Be Cautious

Attackers value personal information, such as Social Security numbers, credit card numbers, and home addresses. AI-powered social engineering increases the risk of this information falling into the wrong hands. The tactics used are sophisticated and hard to detect.

To protect your personal information, be cautious when interacting with AI-powered voice assistants or chatbots. Provide personal information only to trusted sources. Be wary of suspicious emails or phone calls that ask for personal information.

AI has the potential to manipulate people through social engineering. Be aware of these tactics and protect your personal information by being cautious when interacting with AI-powered voice assistants or chatbots. Only reveal personal information to trusted sources and be cautious of suspicious emails or phone calls.

If you like this article, Artificial Intelligence & Social Engineering: You Need to Know, please share!

Related articles:

by Brian Thompson | Feb 2, 2023 | Breach

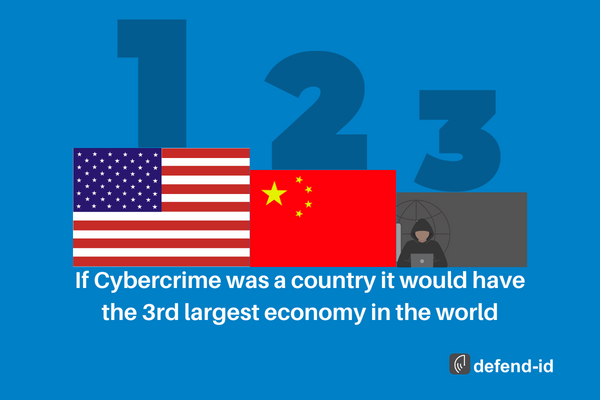

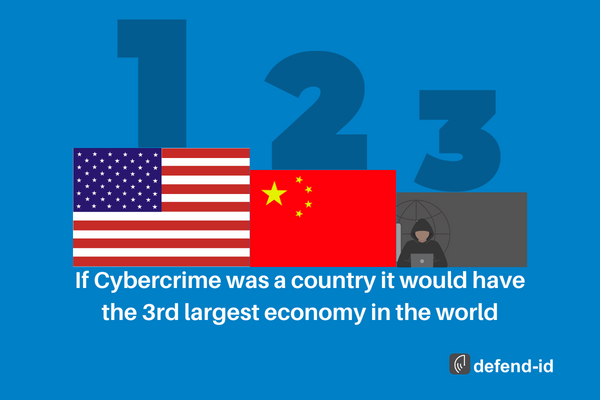

Cybercrime is the third largest economy in the world, with costs estimated at around $8 trillion globally. This staggering figure highlights the alarming reality of the current digital landscape and the importance of taking cybersecurity measures seriously.

The United States and China, two of the largest economies in the world, are not immune to the threat of cybercrime. It is imperative that businesses, government organizations, and individuals take proactive steps to protect their assets and sensitive information. This includes investing in security measures such as firewalls, encryption technologies, and regular software updates, as well as preparing for potential breaches by having a comprehensive response plan in place.

Moreover, companies have a responsibility to protect their employees and customers from the damaging effects of a cyberattack. Personal information, financial data, and confidential business information must be kept secure to prevent identity theft, fraud, and loss of revenue.

Investing in cyber security is not just about protecting assets; it’s also about building trust with stakeholders. To ensure that they are protected against potential attacks, businesses must adopt a transparent and proactive security strategy. They must develop policies and procedures to protect their systems and invest in cutting-edge technology such as firewalls, anti-malware programs, and encryption software

Cybercrime is an alarming reality that is having a significant impact on the global economy. Companies and individuals must take proactive steps to secure their systems and protect sensitive information to avoid the devastating consequences of a cyberattack. The time to invest in cyber security is now, before it is too late.

Feeling unprepared for a breach?

We hear it all the time, breaches happening over and over again but what can we do to prepare for one? What plans do we have in place for when it happens? defend-id4B is here to give you a simple path to ensure you are ready.

defend-id4B provides your business with pre-breach response planning, post-breach regulatory response and notification services, and fully managed fraud recovery for compromised clients. Along with dark web monitoring, and business fraud restoration.

Related Breach article concerning the healthcare industry: Healthcare Breaches and Medical ID Theft

by Brian Thompson | Feb 2, 2023 | Uncategorized

In today’s fast-paced business world, small business owners face numerous challenges. Challenges include the cost of providing valuable employee benefits while also keeping expenses low. However, with the growing threat of identity theft, it’s essential to find a way to protect employees while also securing the success of the business. That’s where the idea of “Protecting Employees and Securing Success” comes into play. By including identity theft protection in employee benefits, small businesses can:

- attract and retain top talent,

- improve employee morale,

- and ensure the safety of their employees’ personal and financial information.

This article will explore the benefits of offering identity theft protection as a benefit and how it can positively impact both employees and the business.

The struggle

Small business owners face a constant struggle in trying to balance the cost of employee benefits with the value that these benefits offer to their employees. In today’s digital age, where a significant amount of personal and financial information is stored online, the threat of identity theft has become a significant concern. This is why many companies have started including identity theft protection in their benefit packages. They are adding ID Theft Protection to not only attract top talent but also to provide added value to their employees.

Identity theft is a growing problem, affecting millions of people every year. In the event of a data breach or other security incident, the aftermath can be a long and costly process for the victim to recover. According to the Identity Theft Resource Center, the average time it takes a victim to recover from identity theft is 600 hours. 600 hours is equivalent to over two and a half weeks of full-time work. This is not only a burden on the victim but also on the company. Companies are losing valuable productivity and face increased costs associated with their employee’s recovery process.

A Solution

Providing identity theft protection as a benefit can help small businesses stand out from their competitors while also providing peace of mind to their employees. It can be an attractive perk for job seekers and help the company attract and retain top talent. In addition, it can be cost-effective compared to the time and resources it takes to recover from identity theft.

Lets face it companies are already paying for their employees to recover on their own. But if they have a professional to help with the recovery process it is much less expensive. A professional identity theft protection service will provide the necessary support and resources for employees to quickly and efficiently recover from identity theft. This can include 24/7 monitoring, credit reports, and fraud resolution services. The cost of these services is usually minimal compared to the cost of lost productivity and the time it takes for an employee to recover on their own.

Another advantage of including identity theft protection as a benefit is that it can help build trust and improve employee morale. When employees know that their employer is taking steps to protect their financial security, they feel valued and appreciated. This, in turn, can lead to increased job satisfaction and a more motivated and productive workforce.

Including identity theft protection as a benefit for small businesses is a smart move. Not only will it provide added value to employees, but it will also set the company apart from its competition. It is also cost-effective compared to the time and resources it takes for employees to recover on their own. So, why wait? Take the first step towards a safer and more competitive workplace. Offer Identity theft protection to your employees with defend-id today.

Agents Offer Identity Theft Protection?

by Brian Thompson | Jan 25, 2023 | Identity Theft

What is Fully Managed Recovery for identity fraud, and how does it improve the employee’s experience?

Fully managed identity theft recovery is a service offered by some companies that helps individuals who have been the victims of identity theft. The service typically includes assistance with canceling and reissuing credit cards, restoring credit reports, and contacting the appropriate authorities to report the identity theft. The service is considered “fully managed” because the company manages the entire process for the individual, from start to finish, and the individual does not have to take on the task of recovering their identity on their own.

Fully managed identity theft recovery can improve the victim’s experience by taking on the burden of dealing with the aftermath of the theft. The process of recovering from identity theft can be time-consuming and overwhelming, especially if the victim is not familiar with the necessary steps. By using a fully managed service, the victim can have peace of mind knowing that a professional is handling the situation and that their identity will be restored as quickly as possible.

Additionally, fully managed identity theft recovery can provide a higher level of protection for victims. The company will have experienced and trained professionals who know the procedures and regulations for identity theft recovery and can help the victims minimize the damage. They also have specialized knowledge to help the victims prevent future identity theft.

Finally, the fully managed service can provide victims with access to resources and support throughout the recovery process. They can help answer questions and provide guidance, which can be especially helpful for victims who are not familiar with the process.

Stop worrying about identity theft and breach compliance. Let us worry about that, it is OUR job, not yours.

Another way of looking at it:

Fully-Managed Recovery for Identity Theft

Similar articles: