by Brian Thompson | Mar 15, 2023 | Breach, General, Identity Theft

Silicon Valley Bank (SVB) collapsed on March 10, 2023, which has caused a ripple effect throughout the global financial system. Unfortunately, the SVB Collapse Enables Scammers to take advantage of the situation and use the bank’s downfall to scam people.

SVB was a US-based commercial bank and the 16th largest bank in the country, which also happened to be the largest bank by deposits in Silicon Valley, California. The bank failed after a run on its deposits, which has impacted many businesses and people in the technology, life science, healthcare, private equity, venture capital, and premium wine industries who were customers of SVB.

What they are using

Security researchers have noted that hackers are registering suspicious domains and conducting phishing campaigns, preparing for business email compromise (BEC) attacks. These attacks aim to steal money, steal account data, or infect targets with malware.

Researcher Johannes Ulrich has reported that threat actors are already registering suspicious domains related to SVB that are very likely to be used in attacks. Cyber-intelligence firm Cyble has also published a report exploring developing SVB-themed threats and warning about additional domains. Some examples given in a report published on the SANS ISC and Cyble websites include:

- login-svb.com,

- svbbailout.com,

- svbcertificates.com, svbclaim.com,

- svbcollapse.com,

- svbdeposits.com,

- svbhelp.com,

- svblawsuit.com.

- svbdebt.com,

- svbclaims.net,

- svb-usdc.com,

- svb-usdc.net,

- svbi.io,

- banksvb.com,

- svbank.com,

- svblogin.com.

Many of these sites were registered on the day of the bank’s collapse and are already hosting cryptocurrency scams.

How they are using it

The scammers might attempt to contact former clients of SVB to offer them a support package, legal services, loans, or other fake services relating to the bank’s collapse. Some threat actors are impersonating SVB customers and telling customers that they need payments sent to a new bank account after the bank’s collapse. However, these bank accounts belong to the threat actors, who steal payments meant to go to the legitimate company.

These scam pages tell SVB customers that the bank is distributing USDC as part of a “payback” program. However, clicking on the site’s ‘Click here to claim’ button brings up a QR code that attempts to compromise crypto wallets when scanned.

In another case, the threat actors behind “cash4svb.com” attempt to phish former SVB customers’ contact information who are trade creditors or lenders, promising them a return between 65% and 85%.

SVB Collapse Enables Scammers to take advantage of the situation and use the bank’s downfall to scam people. Overall, people must be vigilant about these scams and take steps to protect themselves from cybercriminals.

related articles

by Brian Thompson | Mar 9, 2023 | Identity Theft

Open season for Tax Identity Thieves is in full swing. They are ready for you to procrastinate, to hold off on doing your taxes because they are ready to do it for you.

Tax identity theft occurs when the bad guy uses your Social Security Number (SSN) to file a fake tax return and collect your refund. You are unlikely to find out about it until you attempt to file your real tax return and it is rejected by the IRS as a duplicate. The fraudulent use of your SSN means you also may be at risk for other types of identity theft.

What to do.

-

Beat them to it and file your taxes as early as possible to ensure you do not become a victim. This is extremely important if you know your information has been part of any one of the data breaches over the years or if you have had your identity stolen in the past already.

-

Protect your Social Security Number whenever possible. You are often asked for your SSN on forms but it is not always necessary. Do not provide your SSN unless it is absolutely needed.

-

Beware of SCAMS. Lookout for Government imposters threatening fines, arrest or cancellation of your SSN if you do not pay them immediately. They will usually ask you to pay with a gift card or prepaid debit card. If you pay them, you will never see your money again. Some scammers will ask you to confirm your identity by providing your SSN, again, do not. Remember, the IRS will contact you first by mail. Additionally, the IRS will never email you, send you a text or contact you on a social network.

-

Secure your network. If you are filing electronically, use a secure, password-protected network or Virtual Private Network (VPN) connection to do so. You can also mail your returns directly from the Post Office, do not put them in your personal mailbox with the flag up!

-

Know your tax person! If you are using someone to prepare your taxes, you must go through your due diligence before you hand over your Personally Identifiable Information, (PII).

What if it happens to me?

- First, contact the IRS as soon as you can. Keep careful documentation of everything and stay in touch with the IRS until the issue is resolved.

- Second, file a complaint with the Federal Trade Commission.

- Third, file a complaint with the local police department.

- Fourth, put a fraud alert on your credit file with all three credit bureaus.

It is an open hunting season for identity thieves but we don’t have to be deer in headlights, take these steps and mitigate your risk.

Hunting season for Tax Identity Thieves is in full swing and its time to know your rights: PDF HERE

If you don’t want to fight this fight alone, get identity theft protection and mitigate your risks with monitoring, cover your losses with insurance and ensure peace of mind with a place to turn with full-service recovery experts. Read more about identity theft protection here: 14 features of Identity Theft Protection Monitoring and the Most Important Feature!

by Brian Thompson | Mar 1, 2023 | Identity Theft

Agents, you have a unique opportunity to help protect your clients from the threat of identity theft by offering protection as part of your benefits package. Don’t Wait to Protect Your Clients. Below you will find five persuasive reasons why you should start offering it to all your clients today.

5 Reasons to offer identity theft

- Protect your clients: Identity theft can lead to significant financial losses, damaged credit scores, and even legal trouble. Help your clients avoid these risks and give them peace of mind with identity theft protection.

- Stay competitive: Identity theft is becoming more prevalent. Many employers are looking to offer or already offer identity theft protection as a standard part of their benefits package. Stay competitive and attract new clients who value this type of protection.

- Build client loyalty: Offering id protection shows your clients that you care about their well-being and are willing to go the extra mile to protect them. This can help build loyalty and keep your clients coming back to you for their benefit needs.

- Increase revenue: Identity theft protection can be a lucrative add-on service, with many providers offering commissions to agents who sell their products. You can increase your revenue and grow your business by providing this service.

- Fulfill your duty of care: As an employee benefits agent, you have a duty of care to your clients to provide them with the best possible protection against risks and threats. You can fulfill this duty and demonstrate to your clients that you value their security by providing identity theft protection.

Offering identity theft protection to your clients is not only the right thing to do, but it also makes good business sense. Help protect your clients, stay competitive, build loyalty, increase revenue, and fulfill your duty of care. Doing so will help ensure that your clients feel safe and secure, and will be more likely to remain loyal customers.

It can be simple too…

by Brian Thompson | Feb 15, 2023 | healthcare, Identity Theft

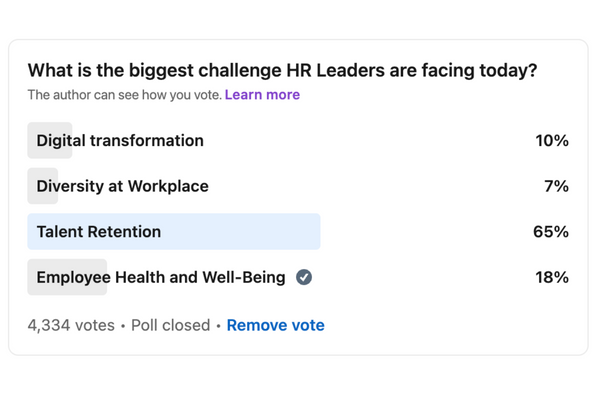

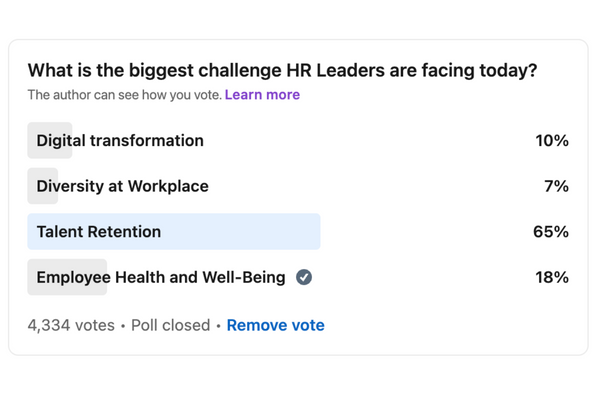

A recent poll asked, “what are the biggest challenges facing HR leaders today”. Given the size of the poll, done on LinkedIn within the Human Resources (HR) Professionals page we thought it would be worth considering and sharing. (worth considering: 1, 2, and 4 may all impact number 3)

The Poll

- According to a poll of 4,334 professionals, talent retention was identified as the top concern by 65% of respondents. Retaining top talent is crucial to the success of any organization, as losing valuable employees can be costly in terms of productivity, morale, and revenue.

- Diversity in the workplace was only a concern for 7% of respondents. While this is a concern very much talked about it is the lowest concern based on the survey.

- The use of technology is increasingly relevant in the workplace. Digital transformation is a concern for 10% of HR professionals surveyed. HR leaders must adapt and leverage new digital tools to stay competitive and efficient in the workplace.

- Employee health and well-being came in at 18%, the second biggest challenge according to HR professionals. HR professionals have a vested interest in promoting employee health and well-being. Focusing on health and wellness can lead to; improved productivity, decreased absenteeism, and increased employee retention. Additionally, demonstrating concern for employee well-being can help build a positive and supportive workplace culture and can have financial benefits for an organization.

Employee benefits

Employee benefits play a vital role in enhancing employee retention, well-being, and productivity. Identity theft protection, in particular, is a critical benefit that should be considered in all four areas mentioned in the poll. Identity theft can impact an employee’s financial well-being, health, and work productivity, and offering identity theft protection can help mitigate these effects. Furthermore, it can enhance digital transformation efforts. If their data is secure, employees will feel more comfortable adopting new digital tools.

There are several challenges facing HR leaders, with talent retention being the most pressing. Nonetheless, diversity in the workplace, employee health and well-being, and digital transformation can also contribute to employee retention and organizational success. HR can enhance employee well-being and improve overall effectiveness by offering employee benefits such as identity theft protection.

Related articles:

by Brian Thompson | Feb 15, 2023 | General, Identity Theft

Tax identity theft is a type of identity theft that occurs when someone uses your personal information to file a fraudulent tax return and claim a refund. It can have serious consequences, including delays in receiving legitimate refunds, penalties for underpayment, and damage to your credit score. In this article, we’ll explain how tax identity theft occurs, how to spot the warning signs, and what you can do to protect yourself from Tax Fraud

How Tax Identity Theft Occurs

Tax identity theft can occur in a number of ways. For example:

- Phishing scams: Scammers request personal information such as Social Security numbers or bank account details through emails or phone calls that appear to be from the IRS.

- Data breaches: Hackers steal personal information from large companies or government agencies and sell it on the black market for tax identity theft purposes.

- Stolen mail: Criminals steal mail that contains personal information, such as tax documents like W-2 forms or 1099s.

- Social engineering: Scammers use social engineering tactics, like creating fake job postings or fake charity organizations, to trick people into revealing personal information.

Warning Signs of Tax Identity Theft

According to the IRS, some of the warning signs of tax identity theft include:

- The IRS sends a letter stating multiple tax returns were filed or unknown wages were received.

- You can’t file an electronic tax return because someone filed with your Social Security number.

- A tax transcript arrives in the mail, despite not requesting it.

- You get an IRS notice that someone opened an online account in your name.

- You receive an unexpected refund or an incorrect refund amount.

- You receive a tax bill for taxes you didn’t owe.

How to Protect Yourself from Tax Fraud

There are several things you can do to protect yourself from tax identity theft:

- Safeguard personal information: Only provide personal details to trusted individuals or organizations. Beware of unsolicited phone calls or emails requesting such information.

- File taxes early: Early filing reduces the risk of a fraudster filing a return in your name.

- Check credit report regularly: Regularly checking your credit report helps you spot unusual activity like unauthorized new accounts or loans.

With defend-id Coverage, Protect Yourself from Tax Fraud

At defend-id, we understand the importance of protecting your identity and your finances from tax fraud. That’s why we offer fully managed recovery programs to help you recover from the effects of identity theft. Our team of experts will work with you to restore your credit, recover lost funds, and ensure that your identity is fully restored. Learn more about our fully managed recovery programs here: What’s Fully Managed Recovery for Identity Fraud

Tax identity theft is a serious threat that can cause financial hardship and personal stress. Protect yourself by being vigilant with personal information, filing taxes early, and checking your credit report regularly. If you do become a victim, Defend-ID’s fully managed recovery program can help restore your identity. Learn more about the program on our blog. Stay safe and secure!

Don’t let tax identity theft damage your finances and your credit. Take steps to Protect Yourself from Tax Fraud, and consider defend-id’s fully managed recovery programs to give you peace of mind.

Learn more: Protect employees from tax fraud. Peace of Mind with a Place to Turn is a great benefit your employees will appreciate.

Related articles: Early Tax Filing Helps Prevent Tax-Related Identity Theft

by Brian Thompson | Feb 9, 2023 | General, Identity Theft, Uncategorized

As a parent, it’s important to be aware of the potential dangers and harmful content on TikTok, a popular social media platform among children. This guide provides information on TikTok parental controls and the reasons why it may be best to keep children off the app.

TikTok Parental Controls: A Guide for Protecting Children

Concerned parents and authorities need a comprehensive guide on TikTok parental controls to protect children from harmful and inappropriate content on the popular social media platform. This tutorial outlines step-by-step instructions to implement TikTok controls and discusses privacy policies.

- Create TikTok Account: Get started by creating a TikTok account for your child, giving you access to all platform features and settings.

- Enable Digital Wellbeing: Go to “Settings & Privacy” and select “Digital Wellbeing” to enable features such as “Screen Time Management” and “Restricted Mode.” These tools help monitor children’s activity and protect them from harmful content.

- Adjust Privacy Settings: Protect your child’s privacy by visiting “Settings & Privacy” and selecting “Privacy and Safety.” Change who can send direct messages, view videos, and see their profile to the most secure options.

- Report Inappropriate Content: Encourage your child to report any inappropriate or harmful content by using TikTok’s reporting feature.

- Educate Children: Parental controls are important, but so is educating children on online safety and the potential dangers of social media. Teach them to be cautious with information they share, avoid strangers, and report any inappropriate behavior or content.

Regarding privacy policies, TikTok collects information such as location, device information, and usage data. While this data improves user experience, it may raise privacy concerns for parents. To protect children’s privacy, review TikTok’s privacy policy and adjust app privacy settings to limit data sharing.

In conclusion, TikTok parental controls provide a vital way to protect children from harmful and inappropriate content on the app. By creating a TikTok account, enabling digital wellbeing features, adjusting privacy settings, reporting inappropriate content, and educating children, parents can ensure a safe and enjoyable TikTok experience for their kids.

There are several reasons why it may be best to keep children off TikTok. Some of the main concerns include:

- Inappropriate Content: TikTok is known for hosting a vast amount of content that may not be suitable for children. This includes content that is sexually explicit, violent, or promotes harmful ideologies.

- Online Safety: TikTok is a social media platform that can be used by predators to target and exploit children. Children may be at risk of being exposed to inappropriate content, cyberbullying, or may become victims of online grooming.

- Screen Time: TikTok is a highly engaging platform that can quickly consume a lot of a child’s time. Spending too much time on TikTok can lead to decreased physical activity, disrupted sleep patterns, and decreased academic performance.

- Privacy Concerns: TikTok collects and stores personal data from its users, which can raise privacy concerns. Children may not understand the implications of sharing personal information online, and their data could be used for malicious purposes. See TikTok Terms of Service

- Intrusive Policies: TikTok’s privacy policies may be considered intrusive, as the app collects and stores a large amount of personal data from its users. This can raise privacy concerns, particularly for children who are vulnerable.

Considering the potential dangers and harmful content on TikTok, it may be best to keep children off the app. Instead, parents can encourage children to spend their time on other, safer and more appropriate activities.

Protecting children on TikTok requires a combination of parental controls, education, and awareness of the potential dangers. By understanding TikTok’s privacy policies, implementing parental controls, and limiting children’s time on the app, parents can ensure a safe and enjoyable online experience for their kids.

Related Articles: