by Brian Thompson | Aug 9, 2023 | Identity Theft

Wifi Safety: Don’t Fall for This Sneaky Trick! Do you use public WiFi? It’s a handy way to stay online while you’re out and about. But be careful! There’s a new trick called WiFi jacking that can steal your info.

Bad guys use a special tool to sneak into public WiFi networks. They can get into your phone and take your personal stuff. This is a big problem, but we can protect ourselves.

WiFi Jacking: A Sneaky Trick Crooks use a strong antenna to do WiFi jacking. They aim it at public WiFi spots and take info from people who are connected. They can grab things like passwords and credit card numbers.

This is really bad because they can use your info to do bad stuff like stealing money or pretending to be you. We need to be careful when we’re on public WiFi.

WiFi Jacking vs. Man-in-the-Middle WiFi jacking sounds like another trick called Man-in-the-Middle. But they’re a bit different.

WiFi jacking steals info from WiFi networks. Man-in-the-Middle attacks mess up conversations between two people online. Both are bad, but WiFi jacking is more about taking info from wireless networks.

Watch Out for Risks WiFi jacking is a problem because it tricks us on public WiFi. We think we’re safe, but the bad guys are listening. We have to be smart and keep our stuff safe.

Here’s what you can do:

- Use Safe WiFi: Pick trusted networks, not ones with strange names.

- Try VPNs: These make a secret path for your info so bad guys can’t take it.

- Use 2FA: Add an extra step when you log in, like a special code sent to your phone.

- Check Websites: Look for “https://” and a lock symbol when you visit a site. That is an indication that it’s safe.

- Update Stuff: Keep your phone and apps up to date. This helps stop bad guys.

Stay Safe and Smart WiFi jacking is a problem, but we can beat it. Connect smartly, use a VPN, try 2FA, and watch out for weird stuff online. Let’s make sure our info stays safe and keep having fun online!

Wifi Safety: Don’t Fall for This Sneaky Trick!

Related Articles:

by Brian Thompson | Aug 2, 2023 | Employee Benefits, Identity Theft

In the evolving landscape of employee benefits, one crucial aspect often remains overlooked: identity theft protection. Employers are striving to provide comprehensive benefits packages that cater to the diverse needs of their workforce. BUT, Identity theft protection is an offering that has yet to receive the attention it truly deserves. There are 4 reasons agents don’t offer identity theft protection.

Below are the four most common objections we hear, keeping identity theft protection from benefits conversations. We unravel the layers of misconception and reveal reasons why identity theft protection should be in every company’s benefits portfolio. From debunking cost concerns to showcasing the tangible advantages for both employers and employees, we’ll illuminate how identity theft protection not only shields against financial turmoil but also nurtures a culture of trust and security within the workplace.

4 Objections

- Cost: While it’s true that identity theft protection can come with a cost, it’s important to consider the potential long-term savings. (defend-id Plans overview – it might be less expensive than you think) In the unfortunate event of a data breach or identity theft incident affecting employees, the costs can skyrocket due to legal fees, reputational damage, and employee downtime. By investing in identity theft protection as an employee benefit, companies proactively mitigate these potential financial burdens. Plus, the cost of offering this benefit is outweighed by improved employee morale, loyalty, and overall productivity.

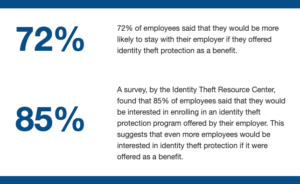

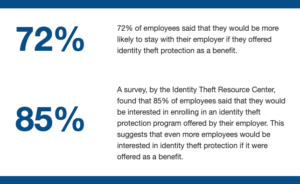

Lack of Demand: It’s understandable to have concerns about demand, but identity theft is a pervasive and growing issue impacting millions of employees yearly. Even if employees haven’t expressed an interest in identity theft protection, it doesn’t mean they wouldn’t value the added security and peace of mind. Offering this benefit demonstrates your commitment to their well-being and financial security. Additionally, proactive education about the risks of identity theft could help employees recognize its importance and drive demand over time. Here are statistics by the Identity Theft Resource Center showing a clear demand for the benefit:

Lack of Demand: It’s understandable to have concerns about demand, but identity theft is a pervasive and growing issue impacting millions of employees yearly. Even if employees haven’t expressed an interest in identity theft protection, it doesn’t mean they wouldn’t value the added security and peace of mind. Offering this benefit demonstrates your commitment to their well-being and financial security. Additionally, proactive education about the risks of identity theft could help employees recognize its importance and drive demand over time. Here are statistics by the Identity Theft Resource Center showing a clear demand for the benefit: - Limited Knowledge: Identity theft protection is increasingly relevant in today’s digital world. Taking the time to familiarize yourself with reputable identity theft protection providers and their features will not only enhance your credibility but also allow you to tailor solutions that best fit your client’s needs. Partnering with knowledgeable providers can also provide the necessary support to address any questions or concerns you may have.

- Concerns about Privacy: Privacy is a valid concern, but reputable identity theft protection providers prioritize data security and confidentiality. When partnering with established providers, you can assure your clients that stringent measures are in place to safeguard sensitive information. Offering identity theft protection can be an opportunity to educate employees about the importance of secure data handling and protection practices. Clear communication about how their data will be used and secured can help alleviate concerns and build trust.

Identity theft protection is a valuable benefit that employers should consider offering to their employees.

It can help to protect employees from the financial and emotional harm of identity theft, and it can also save employers money in the long run.

Cost, lack of demand, limited knowledge, and concerns about privacy are all valid concerns, but they can be overcome. By partnering with a reputable identity theft protection provider, employers can ensure that their employees’ data is secure and that they have access to the resources they need to protect themselves from identity theft.

Offering identity theft protection is a way to show employees that you care about their well-being and financial security. It is also a way to protect your company from the financial and reputational damage caused by an identity theft incident.

If you are an employer, I encourage you to consider offering identity theft protection as a benefit to your employees. It is a wise investment that can protect your employees and your company.

Related Articles

by Brian Thompson | Jul 5, 2023 | Identity Theft

Summertime is a great time to travel, but it’s also a prime time for identity theft. Vacationers are often more relaxed and less vigilant about their personal information, making them easy targets for thieves. Don’t forget to protect yourself from identity theft while you’re away. Identity theft can happen anywhere, including while you’re on vacation. But with a few simple precautions, you can enjoy your trip without worrying about your personal information falling into the wrong hands. Keep reading to learn more about protecting your identity while traveling and get tips for a secure vacation.

Secure your personal documents.

Before you leave for your vacation, make sure to secure your personal documents. This includes your passport, driver’s license, and any other identification cards you may be carrying. Keep these documents in a secure location, such as a hotel safe or a locked suitcase. Avoid carrying unnecessary documents with you, and if you need to bring them, make sure to keep them hidden and out of sight. By taking these precautions, you can minimize the risk of your personal information being stolen while you’re traveling.

Use a VPN when accessing public Wi-Fi.

When you’re traveling and need to connect to public Wi-Fi, it’s important to use a virtual private network (VPN) to protect your identity. Public Wi-Fi networks are often unsecured, making it easy for hackers to intercept your personal information. A VPN creates a secure connection between your device and the internet, encrypting your data and keeping it safe from prying eyes. By using a VPN, you can browse the internet, check your email, and access your online accounts without worrying about your personal information being stolen.

Be cautious with your credit cards.

When traveling, it’s important to be cautious with your credit cards to protect your identity. Avoid using your credit card for purchases at unsecured or unfamiliar locations, as these may be more susceptible to skimming devices or fraudulent activity. Instead, opt for cash or use a secure payment method such as a mobile wallet or chip-enabled card. Additionally, regularly monitor your credit card statements and report any suspicious activity immediately to your credit card company. By taking these precautions, you can enjoy your vacation without the worry of identity theft.

Avoid oversharing on social media.

While it may be tempting to share every detail of your vacation on social media, it’s important to exercise caution. Oversharing can make you a target for identity theft, as criminals can use the information you post to piece together your personal details. Avoid posting your exact travel dates, location, or any other sensitive information that could be used to compromise your identity. Instead, wait until you return home to share your vacation memories. By being mindful of what you share online, you can help protect your identity while traveling.

Keep an eye on your financial statements.

One of the most important steps in protecting your identity while traveling is to regularly monitor your financial statements. This includes checking your bank accounts, credit card statements, and any other financial accounts for any suspicious activity. Look for any unauthorized charges or withdrawals, as these could be signs of identity theft. If you notice anything out of the ordinary, contact your financial institution immediately to report the issue and take steps to protect your accounts. By staying vigilant and keeping an eye on your financial statements, you can help prevent identity theft and enjoy a secure vacation.

Clean out our wallet

Only take the forms of payment you need. If you have your purse or wallet stolen it is easier to remember what cards you have and quicker to limit your exposure.

Check bank accounts and credit cards:

be aware of charges and amounts you have on your accounts and cards. You can also set up alerts to let you know when certain spending or account limits are met.

Use hotel safes

Place anything that has personal information on it that you don’t need in the room safe. This way it isn’t on your person and reduces the risk of it being lost.

Protect your phone

it seems like we should not have to say this but if you do not have a password or biometrics on your phone, set it up before you go

Identity theft can happen anywhere, even on vacation. While there is no foolproof way to prevent it, following these tips can help you reduce your risk of identity theft while on vacation. However, it’s important to remember that there is no foolproof way to prevent it. If you think you’ve been a victim of identity theft, contact your bank, credit card companies, and the Federal Trade Commission (FTC) immediately.

Articles related to: Protecting Your Identity While Traveling: Tips for a Secure Vacation

by Brian Thompson | Jun 29, 2023 | Identity Theft

Your credit report plays a crucial role in your financial well-being, and errors on it can have a significant impact. If you’re concerned about inaccuracies on your credit report, this guide will provide you with step-by-step instructions on how to identify and dispute any errors. By taking control of your credit, you can ensure that your financial information is accurate and protect your overall financial health. Continue reading to learn what you need to know about errors on your credit report.

Understand the Importance of Checking Your Credit Report Regularly.

Checking your credit report regularly is essential for maintaining good financial health. Errors in your credit report can hurt your credit score and make it harder to get loans or credit cards. By reviewing your credit report on a regular basis, you can identify any inaccuracies or fraudulent activity and take the necessary steps to correct them. Don’t wait until you’re in a financial bind to check your credit report; make it a habit to review it at least once a year to ensure its accuracy and protect your financial future.

Review Your Credit Report for Errors and Inaccuracies.

One of the most important steps in maintaining good financial health is to regularly review your credit report for errors and inaccuracies. These errors have a negative impact on your credit score. Low credit scores make it difficult for you to obtain loans or credit cards with favorable interest rates. By taking the time to review your credit report, you can identify any mistakes or fraudulent activity. Then you can take necessary steps to dispute and correct them. Don’t wait until you’re in a financial bind to check your credit report – make it a habit to review it at least once a year to ensure its accuracy and protect your financial future.

Gather Supporting Documentation to Dispute Errors.

When disputing errors on your credit report, it’s important to gather supporting documentation to strengthen your case. This documentation can include things like bank statements, payment receipts, and correspondence with creditors. By providing evidence to support your dispute, you increase your chances of having the error corrected. Keep in mind that it’s important to keep copies of all documentation for your records and to send copies, not originals, when submitting your dispute. Taking the time to gather supporting documentation can make a significant difference in the outcome of your dispute and help you take control of your credit.

Submit a Dispute to the Credit Reporting Agency.

Once you have identified an error on your credit report, the next step is to submit a dispute to the credit reporting agency. This can be done online, by mail, or by phone, depending on the agency’s preferred method. When submitting your dispute, be sure to include all relevant information, such as the specific error you are disputing and any supporting documentation you have gathered. It’s important to be clear and concise in your dispute, and providing all details needed to investigate and correct the error. The credit reporting agency must investigate your dispute within 30 days and respond. If the agency determines that the information is indeed inaccurate, they must correct it on your credit report. Take the time to submit a dispute and provide supporting documentation to take control of your credit and ensure that your credit report is accurate and up-to-date.

Follow Up and Monitor the Resolution of Your Dispute.

After submitting a dispute to the credit reporting agency, it’s important to follow up and monitor the resolution of your dispute. Keep track of the date you submitted the dispute. Make a note to follow up after the designated timeframe for investigation has passed. If you haven’t received a response within the specified timeframe, reach out to the agency to inquire about the status of your dispute. It’s also a good idea to regularly check your credit report to see if the error has been corrected. You can request a free copy of your credit report from each of the three major credit reporting agencies once a year.By staying proactive and tracking your dispute, you can ensure that inaccuracies on your credit report are addressed and corrected quickly.

Summarized

Errors on your credit report can have a significant impact on your financial well-being. By following the steps outlined in this article, you can take control of your credit and ensure that your financial information is accurate.

- Review your credit report regularly. This is the most important step in preventing errors from occurring.

- Gather supporting documentation to dispute any errors you find.

- Submit a dispute to the credit reporting agency. Be clear and concise in your dispute, and provide all relevant information.

- Follow up and monitor the resolution of your dispute. Don’t let the issue go unresolved.

By taking these steps, you can protect your financial future and ensure that your credit report is accurate.

Here are some additional tips for disputing errors on your credit report:

- Be sure to dispute the error within 30 days of discovering it.

- If you are disputing a debt, be sure to provide proof that you have paid it in full.

- Disputing an account that you do not recognize? Be sure to provide proof that you are not the account holder.

- Be persistent in following up with the credit reporting agency.

By following these tips, you can increase your chances of having your error corrected. If you have any questions on what you need to know about errors on credit report contact us here: https://www.defend-id.com/contact

Stay safe and think before you click!

Related articles:

by Brian Thompson | Jun 20, 2023 | Identity Theft

As a mortgage borrower, identity theft protection is something that should be on your radar. With so much personal and financial information exchanged during the mortgage process, it’s important to know why identity theft protection is crucial for mortgage borrowers and to take steps to protect yourself from fraud and identity theft.

Here are some tips to help you secure your identity during the mortgage process and beyond.

- Work with a reputable lender or mortgage broker. Do your due diligence and research any professionals you’re considering working with. Read reviews, ask for referrals from friends and family, and check their credentials.

- Be careful about who you share your personal information with. When filling out mortgage applications or providing financial information, be careful about who you share it with. Never give out personal or financial information to someone who contacts you unsolicited. If you receive a call or email requesting this information, hang up or delete the message and contact your lender or broker directly to verify the request.

- Consider using a credit monitoring service. Consider using a credit monitoring service to keep tabs on your credit report and alert you to any suspicious activity. This can be especially helpful during the mortgage process, when your credit report may be pulled multiple times.

- Freeze your credit report. Another option to consider is freezing your credit report. This prevents anyone from opening new accounts in your name without your permission. Keep in mind that this can also make it more difficult for you to open new accounts, so weigh the pros and cons before taking this step.

- Monitor your financial accounts and credit reports regularly. Finally, be vigilant about monitoring your financial accounts and credit reports even after your mortgage has closed. Set up alerts for any activity on your accounts and regularly check your credit report for any errors or fraudulent activity.

- Ask your lender if they provide identity theft protection during the process and or after as a borrower benefit.

Identity theft is a serious problem, but it can be prevented. By taking these steps, you can help protect your identity and your financial future.

Here are some additional tips to help protect your identity:

- Use strong passwords and change them regularly.

- Be careful about what information you share online.

- Shred or destroy any documents that contain your personal information before you throw them away.

- Be aware of phishing scams.

- Report any suspicious activity to your lender or the credit bureaus immediately.

Protecting your identity may seem like a hassle, but it’s an important step to take to safeguard your finances and personal information. By taking these steps and staying vigilant, you can help prevent identity theft and enjoy a more secure financial future.

Did you know?

- Identity theft is a crime that affects millions of people every year.

- The average victim of identity theft spends 200 hours and $1,200 to recover their identity. FTC

- You can freeze your credit report for free at each of the three credit bureaus.

Related articles:

by Brian Thompson | Jun 14, 2023 | healthcare, Identity Theft

The Positive Impact of Employee Well-Being on Productivity and Performance

In today’s highly competitive business world, companies are searching for ways to boost productivity and performance. However, many employers overlook one crucial factor that can significantly impact their bottom line: employee well-being. Recent studies have shown that employees who feel mentally and physically healthy are more engaged, focused, and productive. Moreover, companies that invest in their employees’ well-being report higher job satisfaction and overall performance. From offering flexible work arrangements, mental health support, financial wellness, and protection programs to promoting physical activity and healthy eating habits, there are countless ways companies can prioritize employee well-being. In this article, we will explore the Positive Impact of Employee Well-Being and share practical tips for creating a workplace culture that supports and encourages a healthy lifestyle.

Understanding the link between employee well-being and productivity

Employee well-being and productivity are closely linked. When employees feel well, they are more likely to be engaged in their work, which lead to increased productivity. Studies have shown that employees who feel mentally and physically healthy are more productive than those who do not. One study found that employees who reported high levels of well-being were almost twice as productive as those who reported low levels of well-being.

Additionally, when employees feel well, they are more likely to be present at work and less likely to take time off due to illness. This leads to increased productivity and less disruption in the workplace.

Overall, there is a clear link between employee well-being and productivity. Prioritizing employee well-being creates a more productive and efficient workplace.

The impact of employee well-being on job satisfaction

Employee well-being also has a significant impact on job satisfaction. Employees are more likely to be satisfied with their job and overall work experience when they feel well, increasing job satisfaction and a higher level of commitment to the company.

Conversely, when employees feel unwell, they are more likely to be dissatisfied with their job and overall work experience, decreasing job satisfaction and increasing turnover.

How employee well-being affects employee Retention

Employee well-being is also closely linked to employee retention. When employees feel well, they are more likely to stay with their current employer. This can lead to increased retention rates and a more stable workforce.

Conversely, when employees do not feel well, they are more likely to look for work elsewhere. This can lead to decreased retention rates and a less stable workforce.

By prioritizing employee well-being, companies can create a more stable and committed workforce.

The Role of Managers in promoting employee Well-being

Managers play a critical role in promoting employee well-being. They are responsible for creating a work environment that supports and encourages employee well-being. This can include offering flexible work arrangements, providing mental health support, promoting physical activity and healthy eating habits, and creating a positive work culture.

Managers can also lead by example. When managers prioritize their well-being, they set an example for their employees to follow. This can create a culture of well-being within the workplace.

Strategies for improving employee well-being

There are countless strategies that companies can use to improve employee well-being. Here are a few examples:

- Offer flexible work arrangements, such as telecommuting or flexible hours.

- Provide mental health support, such as an Employee Assistance Program (EAP).

- Promote physical activity and healthy eating habits; by offering healthy snacks in the workplace or providing discounted gym memberships.

- Create a positive work culture

- Set up a financial wellness and protection program

- include identity theft protection!

Implementing these strategies will create a more supportive and healthy workplace.

The benefits of a workplace wellness program

One effective way to promote employee well-being is through a workplace wellness program. These programs offer a variety of health and wellness services to employees, such as health screenings, fitness classes, and stress management workshops.

Studies have shown that workplace wellness programs can have a significant impact on employee well-being. For example, one study found that employees who participated in a workplace wellness program reported lower levels of stress and higher levels of job satisfaction.

Additionally, workplace wellness programs can also have a positive impact on productivity and performance. By promoting employee well-being, companies can create a more engaged and productive workforce.

Case studies of companies that prioritize employee well-being

Many companies have successfully prioritized employee well-being and have seen positive results. For example, Google offers a wide range of health and wellness services to its employees, including on-site medical care, healthy meals, and fitness classes. As a result, Google has been able to attract and retain top talent and has been consistently ranked as one of the best places to work.

Another example is Patagonia, a clothing company that offers a variety of health and wellness services to its employees, such as on-site childcare and paid time off for volunteering. As a result, Patagonia has a highly committed workforce and has been able to maintain high retention rates.

Measuring the Success of employee well-being Initiatives

To ensure the success of employee well-being initiatives, it is important to measure their impact. This can be done through employee surveys, productivity metrics, and retention rates.

By measuring the success of employee well-being initiatives, companies can identify areas for improvement and make data-driven decisions about how to prioritize employee well-being.

Conclusion: Investing in employee well-being for long-term success

Employee well-being is a crucial factor in boosting productivity and performance. Prioritizing employee well-being creates a more engaged, productive, and committed workforce. This leads to increased retention rates, job satisfaction, and overall performance.

There are countless ways companies can prioritize employee well-being, such as offering flexible work arrangements, providing mental health support, promoting physical activity and healthy eating habits, and creating a positive work culture. Additionally, workplace wellness programs can be an effective way to promote employee well-being.

By measuring the success of employee well-being initiatives, companies can identify areas for improvement and make data-driven decisions about how to prioritize employee well-being. Overall, investing in in a program will have a Positive Impact of Employee Well-Being and is essential for long-term success in today’s competitive business world.

Related Articles:

Lack of Demand

Lack of Demand